Pottery Barn 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

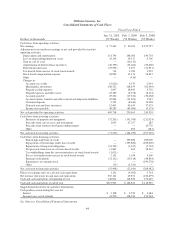

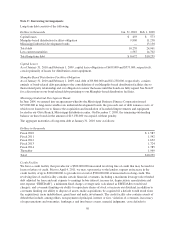

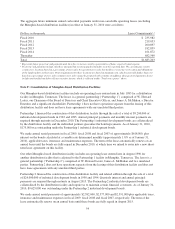

Note C: Borrowing Arrangements

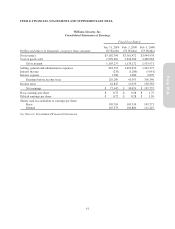

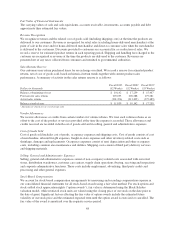

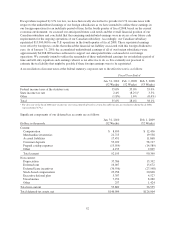

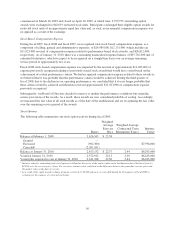

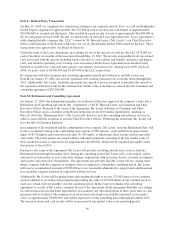

Long-term debt consists of the following:

Dollars in thousands Jan. 31, 2010 Feb. 1, 2009

Capital leases $ 459 $ 573

Memphis-based distribution facilities obligation 9,800 11,238

Mississippi industrial development bonds — 13,150

Total debt 10,259 24,961

Less current maturities 1,587 14,702

Total long-term debt $ 8,672 $10,259

Capital Leases

As of January 31, 2010 and February 1, 2009, capital lease obligations of $459,000 and $573,000, respectively,

consist primarily of leases for distribution center equipment.

Memphis-Based Distribution Facilities Obligation

As of January 31, 2010 and February 1, 2009, total debt of $9,800,000 and $11,238,000, respectively, consists

entirely of bond-related debt pertaining to the consolidation of our Memphis-based distribution facilities due to

their related party relationship and our obligation to renew the leases until the bonds are fully repaid. See Note F

for a discussion on our bond-related debt pertaining to our Memphis-based distribution facilities.

Mississippi Industrial Development Bonds

In June 2004, we entered into an agreement whereby the Mississippi Business Finance Corporation issued

$15,000,000 in long-term variable rate industrial development bonds, the proceeds, net of debt issuance costs, of

which were loaned to us to finance the acquisition and installation of leasehold improvements and equipment

located in our Olive Branch, Mississippi distribution center. On December 7, 2009, the remaining outstanding

balance on these bonds in the amount of $13,150,000 was repaid, without penalty.

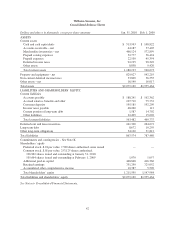

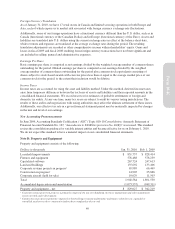

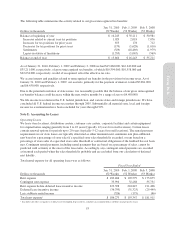

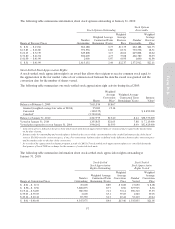

The aggregate maturities of long-term debt at January 31, 2010 were as follows:

Dollars in thousands

Fiscal 2010 $ 1,587

Fiscal 2011 1,542

Fiscal 2012 1,652

Fiscal 2013 1,724

Fiscal 2014 1,785

Thereafter 1,969

Total $10,259

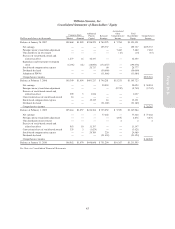

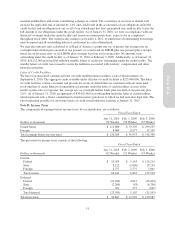

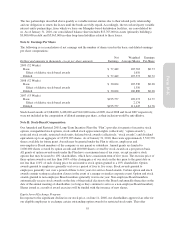

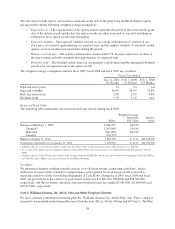

Credit Facility

We have a credit facility that provides for a $300,000,000 unsecured revolving line of credit that may be used for

loans or letters of credit. Prior to April 4, 2011, we may, upon notice to the lenders, request an increase in the

credit facility of up to $200,000,000, to provide for a total of $500,000,000 of unsecured revolving credit. The

revolving line of credit facility contains certain financial covenants, including a maximum leverage ratio (funded

debt adjusted for lease and rent expense to earnings before interest, income tax, depreciation, amortization and

rent expense “EBITDAR”), a minimum fixed charge coverage ratio (calculated as EBITDAR to total fixed

charges), and covenants limiting our ability to repurchase shares of stock or increase our dividend, in addition to

covenants limiting our ability to dispose of assets, make acquisitions, be acquired (if a default would result from

the acquisition), incur indebtedness, grant liens and make investments. The credit facility also contains events of

default that include, among others, non-payment of principal, interest or fees, violation of covenants, inaccuracy

of representations and warranties, bankruptcy and insolvency events, material judgments, cross defaults to

50