Pottery Barn 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

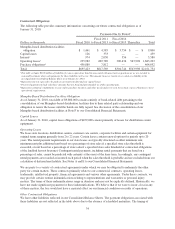

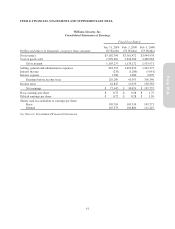

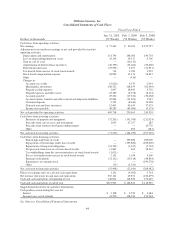

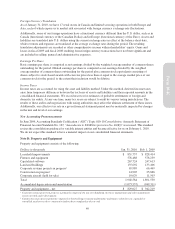

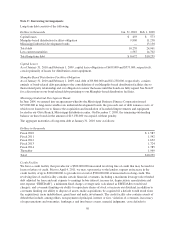

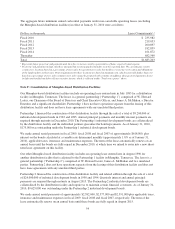

Williams-Sonoma, Inc.

Consolidated Statements of Cash Flows

Fiscal Year Ended

Dollars in thousands

Jan. 31, 2010

(52 Weeks)

Feb. 1, 2009

(52 Weeks)

Feb. 3, 2008

(53 Weeks)

Cash flows from operating activities:

Net earnings $ 77,442 $ 30,024 $ 195,757

Adjustments to reconcile net earnings to net cash provided by (used in)

operating activities:

Depreciation and amortization 151,796 148,083 140,701

Loss on disposal/impairment of assets 33,136 39,317 4,700

Gain on sale of asset — (16,115) —

Amortization of deferred lease incentives (36,799) (31,266) (29,400)

Deferred income taxes (23,595) 5,107 (31,951)

Tax benefit from exercise of stock-based awards 714 1,059 3,922

Stock-based compensation expense 24,989 12,131 26,812

Other — (416) —

Changes in:

Accounts receivable (6,620) 9,579 2,091

Merchandise inventories 108,332 118,679 (81,469)

Prepaid catalog expenses 3,647 18,483 4,702

Prepaid expenses and other assets 23,349 (8,578) (8,161)

Accounts payable 29,202 (27,532) (30,068)

Accrued salaries, benefits and other current and long-term liabilities 42,084 (24,361) 5,945

Customer deposits 2,353 (8,644) 13,458

Deferred rent and lease incentives 12,403 49,619 37,675

Income taxes payable 48,285 (85,006) (9,175)

Net cash provided by operating activities 490,718 230,163 245,539

Cash flows from investing activities:

Purchases of property and equipment (72,263) (191,789) (212,024)

Proceeds from sale of assets and investments 1,033 47,257 285

Proceeds from software developer reimbursement — — 14,770

Other — 493 (281)

Net cash used in investing activities (71,230) (144,039) (197,250)

Cash flows from financing activities:

Borrowings under line of credit — 195,800 189,000

Repayments of borrowings under line of credit — (195,800) (189,000)

Repayments of long-term obligations (14,702) (1,617) (2,703)

Net proceeds from exercise of stock-based awards 11,861 461 28,362

Tax withholdings from the conversion/release of stock-based awards (3,621) — —

Excess tax benefit from exercise of stock-based awards 2,131 1,034 5,100

Payment of dividends (51,132) (50,518) (48,863)

Repurchases of common stock — — (190,378)

Other (35) (1,520) —

Net cash used in financing activities (55,498) (52,160) (208,482)

Effect of exchange rates on cash and cash equivalents 1,131 (4,092) 3,714

Net increase (decrease) in cash and cash equivalents 365,121 29,872 (156,479)

Cash and cash equivalents at beginning of year 148,822 118,950 275,429

Cash and cash equivalents at end of year $513,943 $ 148,822 $ 118,950

Supplemental disclosure of cash flow information:

Cash paid/(received) during the year for:

Interest $ 3,198 $ 2,550 $ 3,484

Income taxes, net of refunds (8,593) 118,356 154,948

See Notes to Consolidated Financial Statements.

44