Pottery Barn 2009 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

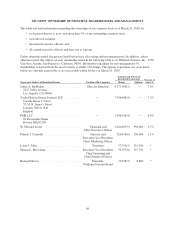

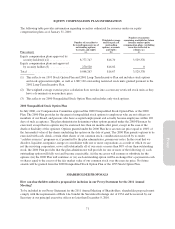

Name and Address of Beneficial Owner Position with Company

Amount and Nature of

Beneficial Ownership Percent of

Class(1)Shares Options

Adrian D.P. Bellamy ............................ Director 83,612 99,750 *

Adrian T. Dillon ................................ Director 17,225 36,750 *

Anthony A. Greener ............................. Director 10,005 6,750 *

Ted W. Hall ................................... Director 10,005 6,750 *

Michael R. Lynch ............................... Director 2,300 130,750 *

Richard T. Robertson ............................ Director 14,255(10) 123,250 *

David B. Zenoff ................................ Director 11,000 32,250 *

All current executive officers and directors as a group

(13 persons) ................................. — 3,222,624(11) 3,296,966 5.9%

* Less than 1%.

(1) Assumes exercise of stock options currently exercisable or exercisable within 60 days of March 29, 2010 by

the named individual into shares of our common stock. Based on 107,452,150 shares outstanding as of

March 29, 2010.

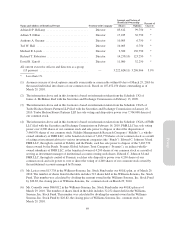

(2) The information above and in this footnote is based on information taken from the Schedule 13G of

James A. McMahan filed with the Securities and Exchange Commission on February 13, 2009.

(3) The information above and in this footnote is based on information taken from the Schedule 13G/A of

Taube Hodson Stonex Partners LLP filed with the Securities and Exchange Commission on January 26,

2010. Taube Hodson Stonex Partners LLP has sole voting and dispositive power over 7,704,008 shares of

our common stock.

(4) The information above and in this footnote is based on information taken from the Schedule 13G/A of FMR

LLC filed with the Securities and Exchange Commission on February 16, 2010. FMR LLC has sole voting

power over 4,200 shares of our common stock and sole power to dispose or direct the disposition of

7,446,970 shares of our common stock. Fidelity Management & Research Company (“Fidelity”), a wholly-

owned subsidiary of FMR LLC, is the beneficial owner of 7,462,770 shares of our common stock as a result

of acting as investment adviser to various investment companies (the “Funds”). Edward C. Johnson 3d and

FMR LLC, through its control of Fidelity and the Funds, each has sole power to dispose of the 7,462,770

shares owned by the Funds. Pyramis Global Advisors Trust Company (“Pyramis”), an indirect wholly-

owned subsidiary of FMR LLC, is the beneficial owner of 4,200 shares of our common stock as a result of

serving as investment manager of institutional accounts owning such shares. Edward C. Johnson 3d and

FMR LLC, through its control of Pyramis, each has sole dispositive power over 4,200 shares of our

common stock and sole power to vote or direct the voting of 4,200 shares of our common stock owned by

the institutional accounts managed by Pyramis.

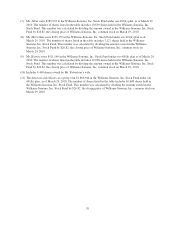

(5) Mr. Lester owns $13,738 in the Williams-Sonoma, Inc. Stock Fund under our 401(k) plan, as of March 29,

2010. The number of shares listed in the table includes 512 shares held in the Williams-Sonoma, Inc. Stock

Fund. This number was calculated by dividing the amount owned in the Williams-Sonoma, Inc. Stock Fund

by $26.82, the closing price of Williams-Sonoma, Inc. common stock on March 29, 2010.

(6) Mr. Connolly owns $865,012 in the Williams-Sonoma, Inc. Stock Fund under our 401(k) plan as of

March 29, 2010. The number of shares listed in the table includes 32,252 shares held in the Williams-

Sonoma, Inc. Stock Fund. This number was calculated by dividing the amount owned in the Williams-

Sonoma, Inc. Stock Fund by $26.82, the closing price of Williams-Sonoma, Inc. common stock on

March 29, 2010.

69

Proxy