Pottery Barn 2009 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

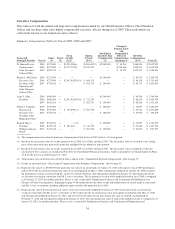

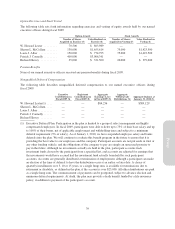

Change-of-Control Arrangements” beginning on page 40 for further discussion about modifications of awards made in connection with

Mr. Lester’s retirement.

(8) Represents the fair value of an award granted on May 2, 2008, plus the incremental fair value resulting from the subsequent modification

of the award on October 28, 2008 to remove a performance-based vesting criterion. The total fiscal 2008 fair value is calculated

as the sum of (i) $944,986, the grant date fair value of the award as of May 2, 2008, and (ii) $332,241, the incremental fair value of the

modified award, computed as of October 28, 2008, the modification date.

(9) Represents the fair value of an award granted on May 2, 2008, plus the incremental fair value resulting from the subsequent modification

of the award on October 28, 2008 to remove a performance-based vesting criterion. The total fiscal 2008 fair value is calculated

as the sum of (i) $471,996, the grant date fair value of the award as of May 2, 2008, and (ii) $165,946, the incremental fair value of the

modified award, computed as of October 28, 2008, the modification date.

(10) Represents the incremental fair value resulting from the modification of an award granted on January 6, 2006 and subsequently modified

on October 28, 2008 to remove a performance-based vesting criterion. The total fiscal 2008 incremental fair value is $1,416,000,

computed as of October 28, 2008, the modification date.

(11) Represents the fair value of an award granted on May 2, 2008, plus the incremental fair value resulting from the subsequent modification

of the award on October 28, 2008 to remove a performance-based vesting criterion. The total fiscal 2008 fair value is calculated

as the sum of (i) $377,994, the grant date fair value of the award as of May 2, 2008, and (ii) $132,896, the incremental fair value of the

modified award, computed as of October 28, 2008, the modification date.

(12) Restricted stock units were granted as part of the Williams-Sonoma, Inc. Equity Award Exchange, which was approved by shareholders

at the 2008 Annual Meeting and was completed during fiscal 2009. Mr. Harvey was not a named executive officer at the time that the

exchange program began and, accordingly, he was eligible to participate in the exchange program. The restricted stock units granted

pursuant to the exchange had a fair value equal to or less than the fair value of the exchanged eligible awards they replaced. As a result,

no incremental compensation cost was recognized in fiscal 2009 with respect to the grant of such restricted stock units, and no

incremental fair value is reportable in this table. Please see the “Grants of Plan-Based Awards” table on page 36 for further discussion

about these restricted stock unit grants.

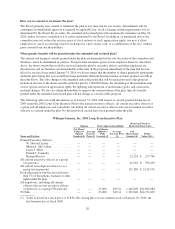

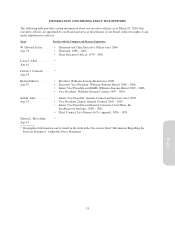

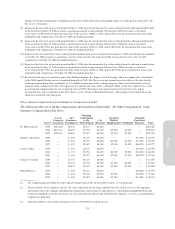

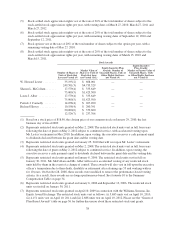

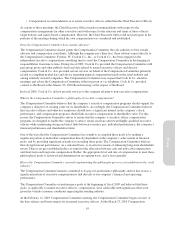

Other Annual Compensation from Summary Compensation Table

The following table sets forth the compensation and benefits included under “All Other Compensation” in the

Summary Compensation table above.

Year(1)

Use of

Corporate

Aircraft(2)

Life

Insurance

Premiums(3)

Matching

Contribution

to the

401(k) Plan(4)

Car

Allowance

Executive

Medical

Supplement(5) Parking(6)

Dividend

Equivalent

Payments Total

W. Howard Lester .... 2009 $463,249 $8,652 $6,125 $6,000 — — — $484,026

2008 $675,772 $8,652 $5,750 $6,000 $2,500 $2,200 — $700,874

2007 $453,614 $8,818 $5,625 $6,500 $2,500 $2,450 — $479,507

Sharon L. McCollam . . . 2009 — $ 630 $6,125 $6,000 — — $72,000 $ 84,755

2008 — $ 630 $5,750 $6,000 $2,500 $2,200 $71,250 $ 88,330

2007 — $ 452 $5,625 $6,500 $2,500 $2,450 $66,750 $ 84,277

Laura J. Alber ....... 2009 — $ 381 $6,125 $6,000 — — $72,000 $ 84,506

2008 — $ 378 $5,750 $6,000 $2,500 $2,200 $71,250 $ 88,078

2007 — $ 443 $5,625 $6,500 $2,500 $2,450 $66,750 $ 84,268

Patrick J. Connolly . . . 2009 — $2,772 $6,125 $6,000 — — — $ 14,897

2008 — $2,772 $5,750 $6,000 $2,500 $2,200 — $ 19,222

2007 — $2,825 $5,625 $6,500 $2,500 $2,450 — $ 19,900

Richard Harvey ...... 2009 — $ 630 $6,125 $6,000 — — $19,200 $ 31,955

2008 — $ 436 $5,750 $6,000 $2,500 — $19,000 $ 33,686

2007 — $ 428 $5,625 $6,500 $2,500 — $17,800 $ 32,853

(1) The compensation reflected in the Other Annual Compensation Table for fiscal 2007 reflects a 53-week period.

(2) For personal use of our corporate aircraft. The value of personal aircraft usage reported above for each fiscal year is the aggregate

incremental cost to the company (including fuel, maintenance and certain fees and expenses) as determined and published from time

to time by Conklin & de Decker Associates, Inc. for each particular aircraft type utilized by the company, as well as a related foregone

corporate tax deduction.

(3) Premiums paid by us for term life insurance in excess of $50,000 for each fiscal year.

35

Proxy