Pottery Barn 2009 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The two partnerships described above qualify as variable interest entities due to their related party relationship

and our obligation to renew the leases until the bonds are fully repaid. Accordingly, the two related party variable

interest entity partnerships, from which we lease our Memphis-based distribution facilities, are consolidated by

us. As of January 31, 2010, our consolidated balance sheet includes $15,765,000 in assets (primarily buildings),

$9,800,000 in debt and $5,965,000 in other long-term liabilities related to these leases.

Corporate Aircraft Transactions

On May 16, 2008, we completed two transactions relating to our corporate aircraft. First, we sold our Bombardier

Global Express airplane for approximately $46,787,000 in cash (a net after-tax cash benefit of approximately

$29,000,000) to an unrelated third party. This resulted in a gain on sale of asset of approximately $16,000,000 in

the second quarter of fiscal 2008. Second, we entered into an Aircraft Lease Agreement (the “Lease Agreement”)

with a limited liability company (the “LLC”) owned by W. Howard Lester, our Chief Executive Officer and

Chairman of the Board of Directors, for use of a Bombardier Global 5000 owned by the LLC. These transactions

were approved by our Board of Directors.

Under the terms of the Lease Agreement, in exchange for use of the aircraft, we will pay the LLC $375,000 for

each of the thirty-six months of the lease term through May 15, 2011. We are also responsible for all use-related

costs associated with the aircraft, including fixed costs such as crew salaries and benefits, insurance and hangar

costs, and all direct operating costs. Closing costs associated with the Lease Agreement were divided evenly

between us and the LLC, and each party paid its own attorney and advisor fees. During fiscal 2009 and fiscal

2008, we paid a total of $4,500,000 and $3,185,000 to the LLC, respectively.

In conjunction with the retirement and consulting agreement entered into between us and Mr. Lester on

January 25, 2010, the aircraft agreement will continue pursuant to its economic terms through May 2011.

Additionally, Mr. Lester, under the agreement, has agreed to give us an option to purchase this aircraft at the

expiration of the lease term for the estimated fair market value at the time we entered into the Consulting

Agreement.

Indemnification Agreements

We have indemnification agreements with our directors and executive officers. These agreements, among other

things, require us to indemnify each director and executive officer to the fullest extent permitted by California

law, including coverage of expenses such as attorneys’ fees, judgments, fines and settlement amounts incurred by

the director or executive officer in any action or proceeding, including any action or proceeding by or in right of

us, arising out of the person’s services as a director or executive officer.

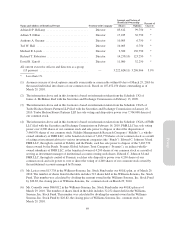

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors, executive officers and

holders of more than 10% of our common stock to file reports regarding their ownership and changes in

ownership of our stock with the SEC. Based upon (i) copies of Section 16(a) reports that we received from such

persons for their fiscal 2009 transactions and (ii) information provided to us by them, we believe that all

reporting requirements under Section 16(a) were met in a timely manner by the persons who were executive

officers, members of the Board of Directors or greater than 10% shareholders during such fiscal year.

67

Proxy