Pottery Barn 2009 Annual Report Download - page 52

Download and view the complete annual report

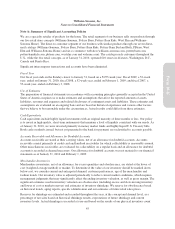

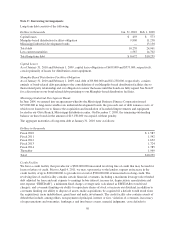

Please find page 52 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are exposed to market risks, which include significant deterioration of the U.S. and foreign markets, changes

in U.S. interest rates, foreign currency exchange rates, including the devaluation of the U.S. dollar, and the

effects of uncertain economic forces which may affect the prices we pay our vendors in the foreign countries in

which we do business. We do not engage in financial transactions for trading or speculative purposes.

Interest Rate Risk

As of January 31, 2010, we had two debt instruments with variable interest rates which subject us to risks

associated with changes in interest rates, the interest payable on our credit facility and the bond-related debt

associated with one of our Memphis-based distribution facilities. As of January 31, 2010, the total outstanding

principal balance on these instruments was $175,000 (with an interest rate of 1.8%) solely pertaining to our

bond-related debt associated with our Memphis-based distribution facilities. If interest rates on these existing

variable rate debt instruments rose 10%, our results from operations and cash flows would not be materially

affected.

In addition, we have fixed and variable income investments consisting of short-term investments classified as

cash and cash equivalents, which are also affected by changes in market interest rates. As of January 31, 2010,

our investments, made primarily in money market funds and highly liquid U.S. Treasury bills, are stated at cost

and approximate their fair values.

Foreign Currency Risks

We purchase a significant amount of inventory from vendors outside of the U.S. in transactions that are

denominated in U.S. dollars; however, only approximately 4% of our international purchase transactions are in

currencies other than the U.S. dollar, primarily the euro. Any currency risks related to these international

purchase transactions were not significant to us during fiscal 2009 and fiscal 2008. Since we pay for the majority

of our international purchases in U.S. dollars, however, a decline in the U.S. dollar relative to other foreign

currencies would subject us to risks associated with increased purchasing costs from our vendors in their effort to

offset any lost profits associated with any currency devaluation. We cannot predict with certainty the effect these

increased costs may have on our financial statements or results of operations.

In addition, as of January 31, 2010, we have 17 retail stores in Canada and limited sourcing operations in both

Europe and Asia, each of which expose us to market risk associated with foreign currency exchange rate

fluctuations. Although these exchange rate fluctuations have not been material to us in the past, we may enter

into foreign currency contracts in the future to minimize any currency remeasurement risk associated with the

intercompany assets and liabilities of our subsidiaries. We did not enter into any foreign currency contracts

during fiscal 2009 or fiscal 2008.

40