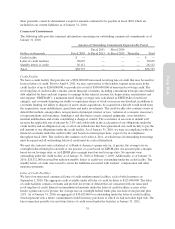

Pottery Barn 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

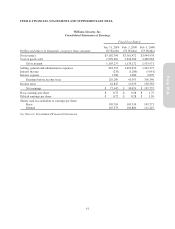

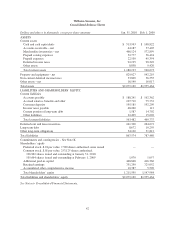

Williams-Sonoma, Inc.

Notes to Consolidated Financial Statements

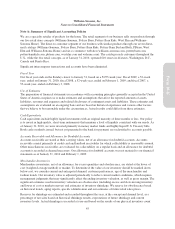

Note A: Summary of Significant Accounting Policies

We are a specialty retailer of products for the home. The retail segment of our business sells our products through

our five retail store concepts (Williams-Sonoma, Pottery Barn, Pottery Barn Kids, West Elm and Williams-

Sonoma Home). The direct-to-customer segment of our business sells similar products through our seven direct-

mail catalogs (Williams-Sonoma, Pottery Barn, Pottery Barn Kids, Pottery Barn Bed and Bath, PBteen, West

Elm and Williams-Sonoma Home) and six e-commerce websites (williams-sonoma.com, potterybarn.com,

potterybarnkids.com, pbteen.com, westelm.com and wshome.com). The catalogs reach customers throughout the

U.S., while the five retail concepts, as of January 31, 2010, operated 610 stores in 44 states, Washington, D.C.,

Canada and Puerto Rico.

Significant intercompany transactions and accounts have been eliminated.

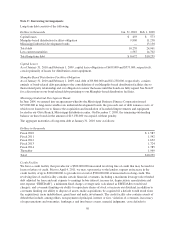

Fiscal Year

Our fiscal year ends on the Sunday closest to January 31, based on a 52/53-week year. Fiscal 2009, a 52-week

year, ended on January 31, 2010; fiscal 2008, a 52-week year, ended on February 1, 2009; and fiscal 2007, a

53-week year, ended on February 3, 2008.

Use of Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United

States of America requires us to make estimates and assumptions that affect the reported amounts of assets,

liabilities, revenues and expenses and related disclosures of contingent assets and liabilities. These estimates and

assumptions are evaluated on an ongoing basis and are based on historical experience and various other factors

that we believe to be reasonable under the circumstances. Actual results could differ from these estimates.

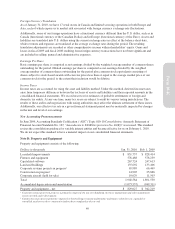

Cash Equivalents

Cash equivalents include highly liquid investments with an original maturity of three months or less. Our policy

is to invest in high-quality, short-term instruments that maintain a level of liquidity consistent with our needs. As

of January 31, 2010, we were invested primarily in money market funds and highly liquid U.S. Treasury bills.

Book cash overdrafts issued, but not yet presented to the bank for payment, are reclassified to accounts payable.

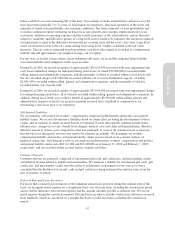

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are stated at their carrying values, net of an allowance for doubtful accounts. Accounts

receivable consist primarily of credit card and landlord receivables for which collectability is reasonably assured.

Other miscellaneous receivables are evaluated for collectability on a regular basis and an allowance for doubtful

accounts is recorded as deemed necessary. Our allowance for doubtful accounts was not material to our financial

statements as of January 31, 2010 and February 1, 2009.

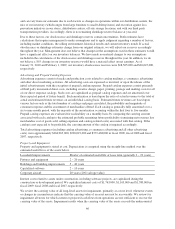

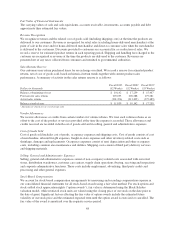

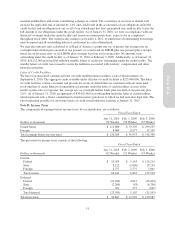

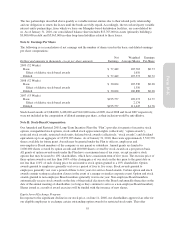

Merchandise Inventories

Merchandise inventories, net of an allowance for excess quantities and obsolescence, are stated at the lower of

cost (weighted average method) or market. To determine if the value of our inventory should be marked down

below cost, we consider current and anticipated demand, customer preferences, age of the merchandise and

fashion trends. Our inventory value is adjusted periodically to reflect current market conditions, which requires

management judgments that may significantly affect the ending inventory valuation, as well as gross margin. The

significant estimates used in inventory valuation are obsolescence (including excess and slow-moving inventory

and lower of cost or market reserves) and estimates of inventory shrinkage. We reserve for obsolescence based

on historical trends, aging reports, specific identification and our estimates of future retail sales prices.

Reserves for shrinkage are estimated and recorded throughout the year, at the concept and channel level, as a

percentage of net sales based on historical shrinkage results, expectations of future shrinkage and current

inventory levels. Actual shrinkage is recorded at year-end based on the results of our physical inventory count

45

Form 10-K