Pottery Barn 2009 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

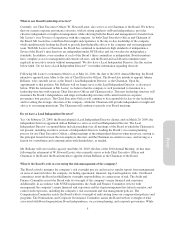

PROPOSAL 2

AMENDMENT AND RESTATEMENT OF OUR 2001 LONG-TERM INCENTIVE PLAN

What is this proposal?

This is a proposal to approve the amendment and restatement of the Williams-Sonoma, Inc. 2001 Long-Term

Incentive Plan to increase the shares issuable under the plan by 2,500,000 shares and extend the term of the plan

to 2020. We are also seeking shareholder approval of the material terms of the 2001 Long-Term Incentive Plan

for purposes of complying with Section 162(m) of the Internal Revenue Code, or Section 162(m).

If shareholders approve amending and restating the 2001 Long-Term Incentive Plan, the amended and restated

2001 Long-Term Incentive Plan will replace the current version of the 2001 Long-Term Incentive Plan.

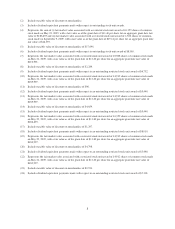

What changes are being made to the current plan?

The amended and restated plan will increase the number of authorized shares of our common stock available for

grant by 2,500,000 shares. The changes will help us to continue to achieve our goal of attracting, retaining and

motivating our talented employees. If the amended and restated plan is approved, the plan will remain in effect

until May 26, 2020, unless sooner terminated by our Board or further extended. We are also seeking shareholder

approval of the material terms of the 2001 Long-Term Incentive Plan for purposes of complying with

Section 162(m) and updating the performance goals that can be used to determine the vesting of awards intended

to qualify as “performance-based” for purposes of Section 162(m). In addition, the amended and restated 2001

Long-Term Incentive Plan will provide that options and stock appreciation rights granted under the amended and

restated plan will expire no later than 7 years from the date of grant. The 2001 Long-Term Incentive Plan

previously provided for a maximum term of 10 years for such awards. In addition, the amended and restated plan

has been modified to prohibit the cancellation of an award in exchange for cash without prior consent from our

shareholders. We also are making some non-material changes to the plan.

If our shareholders approve its material terms, our 2001 Long-Term Incentive Plan will continue to provide the

company with the potential to continue to take tax deductions associated with certain executive compensation,

particularly with respect to certain full-value awards subject to vesting based upon the attainment of specified

objective performance criteria.

Awards granted under the amended and restated 2001 Long-Term Incentive Plan may be designed to qualify as

“performance-based” compensation within the meaning of Section 162(m). Pursuant to Section 162(m), the

company generally may not deduct for federal income tax purposes compensation paid to our Chief Executive

Officer or our three other highest paid employees to the extent that any of these persons receive more than

$1,000,000 in compensation in any single year. However, if the compensation qualifies as “performance-based”

for Section 162(m) purposes, the company may deduct for federal income tax purposes the compensation paid

even if such compensation exceeds $1,000,000 in a single year. For certain awards granted under the 2001 Long-

Term Incentive Plan to qualify as “performance-based” compensation under Section 162(m), among other things,

our shareholders must approve the material terms of the amended and restated 2001 Long-Term Incentive Plan at

the 2010 Annual Meeting. A favorable vote for this proposal will allow us to continue to deduct certain executive

compensation in excess of $1,000,000 and provide us with potentially significant future tax benefits and

associated cash flows.

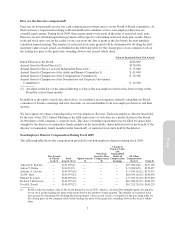

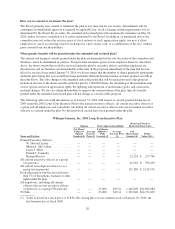

How many shares are available for issuance under the amended and restated plan?

The amended and restated plan will increase the number of shares reserved for issuance by 2,500,000 shares. In

addition to this increase, and as currently permitted under the current plan as a result of prior shareholder

approval in 2006, the number of authorized shares of our common stock available for issuance will continue to

also include any shares subject to outstanding options under our 1993 Stock Option Plan and our 2000

Nonqualified Stock Option Plan that subsequently expire unexercised, up to a maximum of 754,160 shares.

The maximum number of shares from expired options granted under the 1993 Stock Option Plan and our 2000

Nonqualified Stock Option Plan has been attained; as a result, no future option expirations under such plans will

17

Proxy