Pottery Barn 2009 Annual Report Download - page 114

Download and view the complete annual report

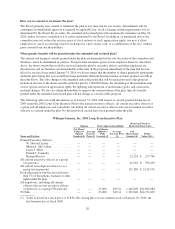

Please find page 114 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.What is a stock option?

A stock option is the right to acquire shares of our common stock at a fixed exercise price for a fixed period of

time. Under the plan, the committee may grant nonqualified stock options and incentive stock options. Our

practice has been to grant nonqualified stock options under the plan. The committee will determine the number of

shares covered by each option, but the committee may not grant more than an aggregate of 1,000,000 shares

covered by options or stock appreciation rights to any one person during any calendar year. The shares available

for issuance under the plan will be reduced by one share for every share subject to an option granted under the

plan, and if the award expires or becomes unexercisable without having been exercised in full, the reserve of

shares available for future awards will be replenished by one share for every one share subject to the expired or

forfeited portion of the award.

What is the exercise price of an option?

The exercise price of the shares subject to each option is set by the committee, but cannot be less than 100% of

the fair market value on the date of grant of the shares covered by the option. The fair market value of shares

covered by an option is calculated as the closing price of our stock on the trading day prior to the grant date.

With respect to an incentive stock option granted to a shareholder who holds more than 10% of the combined

voting power of all classes of stock of the company or any parent or subsidiary, the exercise price cannot be less

than 110% of the fair market value on the date of grant.

When can an option be exercised?

An option granted under the plan generally cannot be exercised until it vests. The committee establishes the

vesting schedule of each option at the time of grant. Options granted under the amended and restated plan expire

at the times established by the committee, but not later than 7 years after the grant date (and not later than 5 years

after the grant date in the case of an incentive stock option granted to an optionee who is a shareholder who holds

more than 10% of the combined voting power of all classes of stock of the company or any parent or subsidiary).

Except as the committee may otherwise provide, stock options generally may be exercised, to the extent vested,

at any time prior to the earlier of the expiration date of the option or 90 days from the date the optionee ceases to

provide services to us for any reason other than death or disability. If the optionee ceases to provide services to

us as a result of his or her death or disability, or the optionee dies within 30 days after the optionee ceases to be

an employee, the option generally may be exercised, to the extent vested, at any time prior to the earlier of the

expiration date of the option or 180 days from the optionee’s death or date of termination as a result of disability.

How can optionees pay us for the exercise price of an option?

The exercise price of each option granted under the plan may be paid by any of the methods included in a

participant’s option agreement. Such methods may include payment by (i) cash, (ii) certified or bank check,

(iii) through the tender of shares that are already owned by the participant, (iv) through a cashless exercise, or

(v) through a net exercise. The participant must pay any taxes we are required to withhold at the time of exercise.

If permitted by the committee, such taxes may be paid through the withholding of shares issued as a result of an

award’s exercise.

What is restricted stock?

Restricted stock awards are shares of our common stock granted to participants subject to vesting in accordance

with the terms and conditions established by the committee. Awards of restricted stock may be granted at no cost

to the participant. The committee will determine the number of shares of restricted stock granted to any

participant, but no participant may be granted more than an aggregate of 400,000 shares covered by awards of

restricted stock, restricted stock units or deferred stock awards during any calendar year.

How does restricted stock vest?

Vesting of restricted stock awards may be based on the achievement of performance goals established by the

committee and/or on continued service to us. The shares available for issuance under the plan will be reduced by

20