Pottery Barn 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

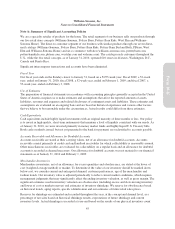

Except where required by U.S. tax law, we have historically elected not to provide for U.S. income taxes with

respect to the undistributed earnings of our foreign subsidiaries as we have intended to utilize those earnings in

our foreign operations for an indefinite period of time. In the fourth quarter of fiscal 2008, based on the current

economic environment, we assessed our anticipated future cash needs and the overall financial position of our

Canadian subsidiary and concluded that the remaining undistributed earnings were in excess of our future cash

requirements for the ongoing operations of our Canadian subsidiary. Accordingly, our Canadian subsidiary

repatriated $13,900,000 to our U.S. operations in the fourth quarter of fiscal 2008. These repatriated earnings

were offset by foreign tax credits that reduced the financial tax liability associated with this foreign dividend to

zero. As of January 31, 2010, the accumulated undistributed earnings of all of our foreign subsidiaries were

approximately $4,968,000 and are sufficient to support our anticipated future cash needs for our foreign

operations. We currently intend to utilize the remainder of these undistributed earnings for an indefinite period of

time and will only repatriate such earnings when it is tax effective to do so. It is currently not practical to

estimate the tax liability that might be payable if these foreign earnings were to be repatriated.

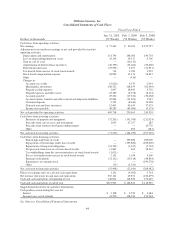

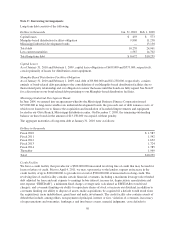

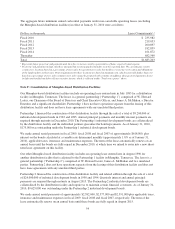

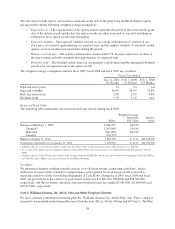

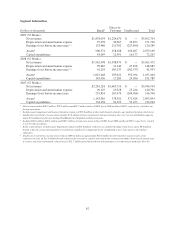

A reconciliation of income taxes at the federal statutory corporate rate to the effective rate is as follows:

Fiscal Year Ended

Jan. 31, 2010

(52 Weeks)

Feb. 1, 2009

(52 Weeks)

Feb. 3, 2008

(53 Weeks)

Federal income taxes at the statutory rate 35.0% 35.0% 35.0%

State income tax rate 2.4% (8.2%)13.5%

Other (1.8%) 1.6% (0.4%)

Total 35.6% 28.4% 38.1%

1The decrease in the fiscal 2008 state income tax rate was primarily driven by certain favorable income tax resolutions during fiscal 2008,

representing (14.7%).

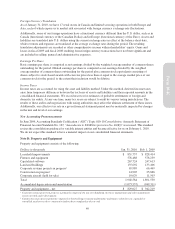

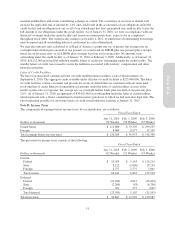

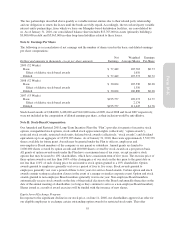

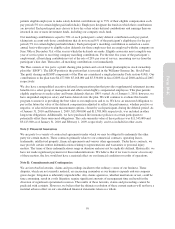

Significant components of our deferred tax accounts are as follows:

Dollars in thousands

Jan. 31, 2010

(52 Weeks)

Feb. 1, 2009

(52 Weeks)

Current:

Compensation $ 8,659 $ 12,436

Merchandise inventories 21,715 19,538

Accrued liabilities 17,451 11,868

Customer deposits 53,229 58,197

Prepaid catalog expenses (13,014) (14,589)

Other 4,155 2,899

Total current 92,195 90,349

Non-current:

Depreciation 37,586 13,392

Deferred rent 16,007 15,672

Deferred lease incentives (36,556) (27,548)

Stock-based compensation 23,956 20,828

Executive deferral plan 5,307 4,527

Uncertainties 7,252 8,260

Other 257 1,424

Total non-current 53,809 36,555

Total deferred tax assets, net $146,004 $126,904

52