Pottery Barn 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

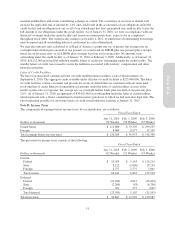

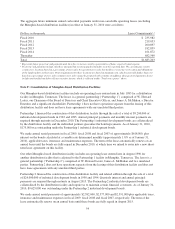

The two partnerships described above qualify as variable interest entities due to their related party relationship

and our obligation to renew the leases until the bonds are fully repaid. Accordingly, the two related party variable

interest entity partnerships, from which we lease our Memphis-based distribution facilities, are consolidated by

us. As of January 31, 2010, our consolidated balance sheet includes $15,765,000 in assets (primarily buildings),

$9,800,000 in debt and $5,965,000 in other long-term liabilities related to these leases.

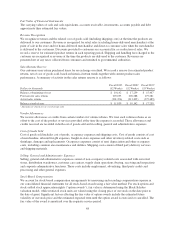

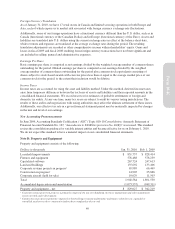

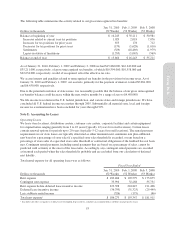

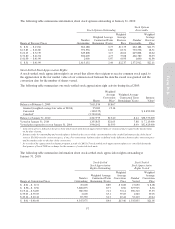

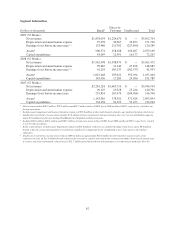

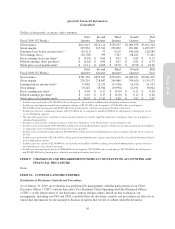

Note G: Earnings Per Share

The following is a reconciliation of net earnings and the number of shares used in the basic and diluted earnings

per share computations:

Dollars and amounts in thousands, except per share amounts

Net

Earnings

Weighted

Average Shares

Earnings

Per-Share

2009 (52 Weeks)

Basic $ 77,442 105,763 $0.73

Effect of dilutive stock-based awards 1,610

Diluted $ 77,442 107,373 $0.72

2008 (52 Weeks)

Basic $ 30,024 105,530 $0.28

Effect of dilutive stock-based awards 1,350

Diluted $ 30,024 106,880 $0.28

2007 (53 Weeks)

Basic $195,757 109,273 $1.79

Effect of dilutive stock-based awards 2,174

Diluted $195,757 111,447 $1.76

Stock-based awards of 2,684,000, 6,428,000 and 5,612,000 in fiscal 2009, fiscal 2008 and fiscal 2007 respectively,

were not included in the computation of diluted earnings per share, as their inclusion would be anti-dilutive.

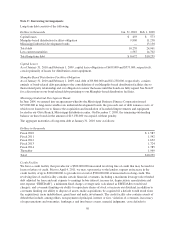

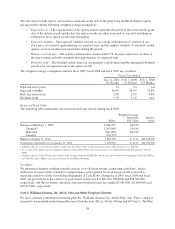

Note H: Stock-Based Compensation

Our Amended and Restated 2001 Long-Term Incentive Plan (the “Plan”) provides for grants of incentive stock

options, nonqualified stock options, stock-settled stock appreciation rights (collectively, “option awards”),

restricted stock awards, restricted stock units, deferred stock awards (collectively, “stock awards”) and dividend

equivalents up to an aggregate of 15,959,903 shares. As of January 31, 2010, there were approximately 3,529,378

shares available for future grant. Awards may be granted under the Plan to officers, employees and

non-employee Board members of the company or any parent or subsidiary. Annual grants are limited to

1,000,000 shares covered by option awards and 400,000 shares covered by stock awards on a per person basis.

All grants of option awards made under the Plan have a maximum term of ten years, except incentive stock

options that may be issued to 10% shareholders, which have a maximum term of five years. The exercise price of

these option awards is not less than 100% of the closing price of our stock on the day prior to the grant date or

not less than 110% of such closing price for an incentive stock option granted to a 10% shareholder. Option

awards granted to employees generally vest over a period of four to five years. Stock awards granted to

employees generally vest over a period of three to five years for service-based awards. Certain option and stock

awards contain vesting acceleration clauses in the event of a merger or similar corporate event. Option and stock

awards granted to non-employee Board members generally vest in one year. Non-employee Board members

automatically receive stock awards on the date of their initial election to the Board and annually thereafter on the

date of the annual meeting of shareholders (so long as they continue to serve as a non-employee Board member).

Shares issued as a result of award exercises will be funded with the issuance of new shares.

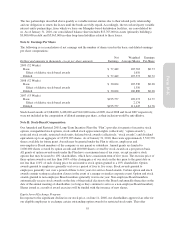

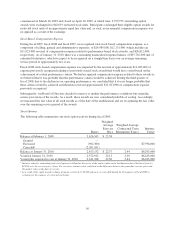

Equity Award Exchange Program

In response to the significant decline in our stock price, on June 11, 2008, our shareholders approved an offer for

our eligible employees to exchange certain outstanding option awards for restricted stock units. This offer

55

Form 10-K