Pottery Barn 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

How are the directors compensated?

Directors do not presently receive any cash compensation for their service on our Board or Board committees. As

their exclusive compensation relating to Board and Board committee service, non-employee directors are

awarded equity grants. During fiscal 2009, these equity grants were made in the form of restricted stock units.

Directors receive dividend equivalent payments with respect to outstanding restricted stock unit awards. These

restricted stock units vest on the earlier of one year from the date of grant or the day before the next regularly

scheduled annual meeting. The number of restricted stock units granted will be determined by dividing the total

monetary value of each award, as identified in the following table, by the closing price of our common stock on

the trading day prior to the grant date, rounding down to the nearest whole share:

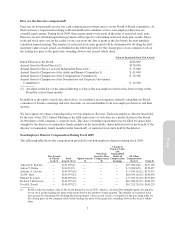

Value of Restricted Stock Unit Awards

Initial Election to the Board ....................................... $184,000

Annual Grant for Board Service(1) ................................. $170,000

Annual Grant for Service as Lead Independent Director(1) .............. $ 25,000

Annual Grant to Chairperson of the Audit and Finance Committee(1) ...... $ 41,000

Annual Grant to Chairperson of the Compensation Committee(1) ......... $ 16,500

Annual Grant to Chairperson of the Nominations and Corporate Governance

Committee(1) ................................................ $ 16,500

(1) Awarded on the date of the Annual Meeting so long as the non-employee director has been serving on the

Board for at least three months.

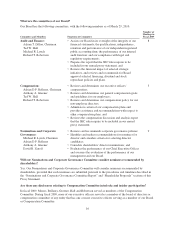

In addition to the equity awards described above, we reimburse travel expenses related to attending our Board,

committee or business meetings and offer discounts on our merchandise to all non-employee directors and their

spouses.

We have approved a share ownership policy for non-employee directors. Each non-employee director must hold,

by the later of the 2012 Annual Meeting or the fifth anniversary of such director’s initial election to the Board,

20,000 shares of the company’s common stock. The share ownership requirement may be filled by shares held

outright by the director (or immediate family member in the household), shares held in trust for the benefit of the

director (or immediate family member in the household), or restricted stock units held by the director.

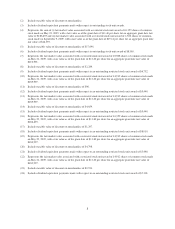

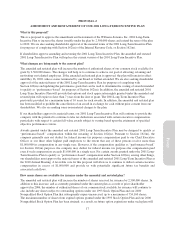

Non-Employee Director Compensation During Fiscal 2009

The following table shows the compensation provided to our non-employee directors during fiscal 2009:

Fees Earned

or Paid in

Cash ($)

Stock

Awards ($)(1)

Option Awards

($)

Non-Stock

Incentive Plan

Compensation

($)

Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings

All Other

Compensation

($)(2)(3) Total ($)

Adrian D.P. Bellamy . . . — $211,490(4) — — — $25,706(5)(6) $237,196

Adrian T. Dillon ...... — $210,991(7) — — — $ 9,036(8)(9) $220,027

Anthony A. Greener . . . — $169,997(10) — — — $ 5,536(11)(12) $175,533

Ted W. Hall .......... — $169,997(13) — — — $10,099(14)(15) $180,096

Michael R. Lynch ..... — $186,493(16) — — — $ 9,307(17)(18) $195,800

Richard T. Robertson . . — $169,997(19) — — — $10,238(20)(21) $180,235

David B. Zenoff ...... — $169,997(22) — — — $10,232(23)(24) $180,229

(1) Based on the fair market value of the award granted in fiscal 2009, which is calculated by multiplying the closing price

of our stock on the trading day prior to the grant date by the number of units granted. The number of restricted stock

units granted is determined by dividing the total monetary value of each award, as identified in the preceding table, by

the closing price of our common stock on the trading day prior to the grant date, rounding down to the nearest whole

share.

7

Proxy