Pottery Barn 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

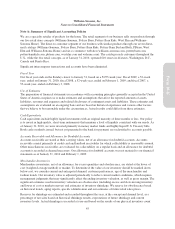

Foreign Currency Translation

As of January 31, 2010, we have 17 retail stores in Canada and limited sourcing operations in both Europe and

Asia, each of which expose us to market risk associated with foreign currency exchange rate fluctuations.

Additionally, some of our foreign operations have a functional currency different than the U.S. dollar, such as in

Canada (functional currency of the Canadian Dollar) and in Europe (functional currency of the Euro). Assets and

liabilities are translated into U.S. dollars using the current exchange rates in effect at the balance sheet date,

while revenues and expenses are translated at the average exchange rates during the period. The resulting

translation adjustments are recorded as other comprehensive income within shareholders’ equity. Gains and

losses in fiscal 2009 and fiscal 2008 resulting from foreign currency transactions have not been significant and

are included in selling, general and administrative expenses.

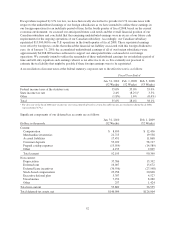

Earnings Per Share

Basic earnings per share is computed as net earnings divided by the weighted average number of common shares

outstanding for the period. Diluted earnings per share is computed as net earnings divided by the weighted

average number of common shares outstanding for the period plus common stock equivalents consisting of

shares subject to stock-based awards with exercise prices less than or equal to the average market price of our

common stock for the period, to the extent their inclusion would be dilutive.

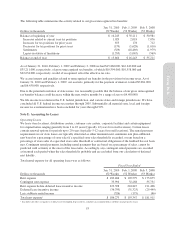

Income Taxes

Income taxes are accounted for using the asset and liability method. Under this method, deferred income taxes

arise from temporary differences between the tax basis of assets and liabilities and their reported amounts in the

consolidated financial statements. We record reserves for estimates of probable settlements of foreign and

domestic tax audits. At any one time, many tax years are subject to audit by various taxing jurisdictions. The

results of these audits and negotiations with taxing authorities may affect the ultimate settlement of these issues.

Additionally, our effective tax rate in a given financial statement period may be materially impacted by changes

in the mix and level of our earnings.

New Accounting Pronouncements

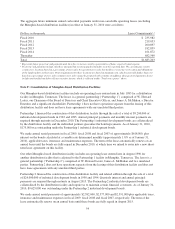

In June 2009, Accounting Standards Codification (“ASC”) Topic 810-10 Consolidation, (formerly Statement of

Financial Account Standards No. 167, “Amendments to FASB Interpretation No. 46(R))” was issued. This standard

revises the consolidation guidance for variable interest entities and became effective for us on February 1, 2010.

We do not expect this standard to have a material impact on our consolidated financial statements.

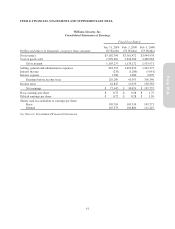

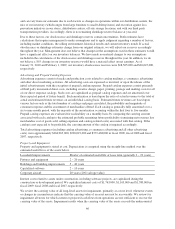

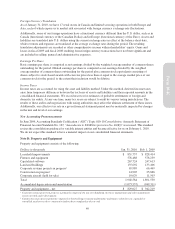

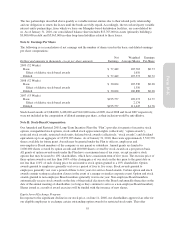

Note B: Property and Equipment

Property and equipment consists of the following:

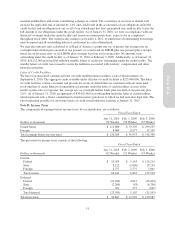

Dollars in thousands Jan. 31, 2010 Feb. 1, 2009

Leasehold improvements $ 831,757 $ 828,414

Fixtures and equipment 576,488 578,259

Capitalized software 267,724 247,613

Land and buildings 135,692 133,406

Corporate systems projects in progress165,989 66,469

Construction in progress214,905 25,866

Corporate aircraft (held for sale) 10,029 11,503

Total 1,902,584 1,891,530

Accumulated depreciation and amortization (1,073,557) (949,311)

Property and equipment – net $ 829,027 $ 942,219

1Corporate systems projects in progress is primarily comprised of a new merchandising, inventory management and order management

system currently under development.

2Construction in progress is primarily comprised of leasehold improvements and furniture and fixtures related to new, expanded or

remodeled retail stores where construction had not been completed as of year-end.

49

Form 10-K