Motorola 2004 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

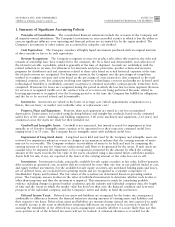

MOTOROLA INC. AND SUBSIDIARIES NOTES TO

CONSOLIDATED FINANCIAL STATEMENTS(Dollars in millions, except as noted)

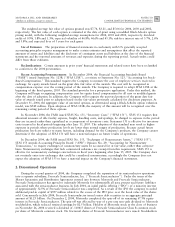

The weighted-average fair value of options granted was $7.74, $3.21, and $5.04 for 2004, 2003 and 2002,

respectively. The fair value of each option is estimated at the date of grant using a modiÑed Black-Scholes option

pricing model, with the following weighted-average assumptions for 2004, 2003 and 2002, respectively: dividend

yields of 0.9%, 1.8% and 1.3%; expected volatility of 46.8%, 46.6% and 45.1%; risk-free interest rate of 3.7%, 2.6%

and 3.8%; and expected lives of 5 years for each grant.

Use of Estimates: The preparation of Ñnancial statements in conformity with U.S. generally accepted

accounting principles requires management to make certain estimates and assumptions that aÅect the reported

amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the Ñnancial

statements and the reported amounts of revenues and expenses during the reporting period. Actual results could

diÅer from those estimates.

ReclassiÑcations: Certain amounts in prior years' Ñnancial statements and related notes have been reclassiÑed

to conform to the 2004 presentation.

Recent Accounting Pronouncements: In December 2004, the Financial Accounting Standards Board

(""FASB'') issued Statement No. 123R (""SFAS 123R''), a revision to Statement No. 123, ""Accounting for Stock-

Based Compensation.'' This standard requires the Company to measure the cost of employee services received in

exchange for equity awards based on the grant date fair value of the awards. The cost will be recognized as

compensation expense over the vesting period of the awards. The Company is required to adopt SFAS 123R at the

beginning of the third quarter, 2005. The standard provides for a prospective application. Under this method, the

Company will begin recognizing compensation cost for equity based compensation for all new or modiÑed grants

after the date of adoption. In addition, the Company will recognize the unvested portion of the grant date fair

value of awards issued prior to adoption based on the fair values previously calculated for disclosure purposes. At

December 31, 2004, the aggregate value of unvested options, as determined using a Black-Scholes option valuation

model, was $540 million. Upon adoption of SFAS 123R, the majority of this amount will be recognized over the

remaining vesting period of these options.

In November 2004, the FASB issued SFAS No. 151, ""Inventory Costs'' (""SFAS 151''). SFAS 151 requires that

abnormal amounts of idle facility expense, freight, handling costs, and spoilage, be charged to expense in the period

they are incurred rather than capitalized as a component of inventory costs. Statement 151 is eÅective for inventory

costs incurred in Ñscal periods beginning after June 15, 2005. The adoption of this standard may result in higher

expenses in periods where production levels are lower than normal ranges of production. Because actual future

production levels are subject to many factors, including demand for the Company's products, the Company cannot

determine if the adoption of SFAS 151 will have a material impact on future results of operations.

In December 2004, the FASB issued SFAS No. 153, ""Exchanges of Nonmonetary Assets,'' (""SFAS 153'').

SFAS 153 amends Accounting Principles Board (""APB'') Opinion No. 29, ""Accounting for Nonmonetary

Transactions,'' to require exchanges of nonmonetary assets be accounted for at fair value, rather than carryover

basis. Nonmonetary exchanges that lack commercial substance are exempt from this requirement. SFAS 153 is

eÅective for nonmonetary exchanges entered into in Ñscal years beginning after June 15, 2005. The Company does

not routinely enter into exchanges that could be considered nonmonetary, accordingly the Company does not

expect the adoption of SFAS 153 to have a material impact on the Company's Ñnancial statements.

2. Discontinued Operations

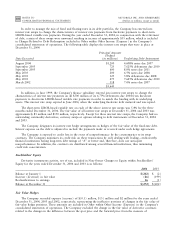

During the second quarter of 2004, the Company completed the separation of its semiconductor operations

into a separate subsidiary, Freescale Semiconductor, Inc. (""Freescale Semiconductor''). Under the terms of the

Master Separation and Distribution Agreement entered into between Motorola and Freescale Semiconductor,

Freescale Semiconductor has agreed to indemnify Motorola for substantially all past, present and future liabilities

associated with the semiconductor business. In July 2004, an initial public oÅering (""IPO'') of a minority interest

of approximately 32.5% of Freescale Semiconductor was completed. As a result of the IPO the company recorded

additional paid-in capital of $397 million related to the excess of the IPO price over the book value of the shares

sold. Concurrently in July 2004, Freescale Semiconductor issued senior debt securities in an aggregate principal

amount of $1.25 billion. On December 2, 2004, Motorola completed the spin-oÅ of its remaining 67.5% equity

interest in Freescale Semiconductor. The spin-oÅ was eÅected by way of a pro rata non-cash dividend to Motorola

stockholders, which reduced retained earnings by $2.5 billion. Holders of Motorola stock at the close of business

on November 26, 2004 received a dividend of .110415 shares of Freescale Semiconductor Class B common stock

per share of Motorola common stock. No fractional shares of Freescale Semiconductor were issued. Stockholders