Motorola 2004 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

For the Year Ended December 31, 2004

For the year ended December 31, 2004, the Company recorded net reversals of $12 million for reserves no

longer needed, including $3 million of charges in Costs of Sales and $15 million of reversals under Reorganization

of Businesses in the Company's consolidated statements of operations.

Included in the aggregate $12 million of net reversals are $59 million of charges for employee separation costs,

$66 million of reversals for employee separation and exit cost reserves no longer needed, and income of $5 million

related to Ñxed asset adjustments. The additional charges of $59 million are a result of the Company's commitment

to productivity improvement plans aimed at improving the Company's ability to meet customer demands and reduce

operating costs. The productivity plans are designed to adjust the Company's workforce to align it with the

Company's focus on seamless mobility and to eliminate positions in its corporate functions in connection with the

separation of the Company's former semiconductor operations into an entirely independent Company, Freescale

Semiconductor. Businesses impacted by these plans include the Commercial, Government and Industrial Solutions

segment, the Integrated Electronic Systems segment and the Broadband Communications segment, as well as various

corporate functions.

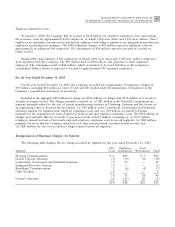

Reorganization of Businesses ChargesÌby Segment

The following table displays the net charges (reversals) for employee separation and exit cost reserves by

segment for the year ended December 31, 2004:

Year Ended

December 31,

Segment 2004

Personal Communications $(27)

Global Telecom Solutions (7)

Commercial, Government and Industrial Solutions 6

Integrated Electronic Systems 10

Broadband Communications (4)

Other Products Ì

(22)

General Corporate 15

$ (7)

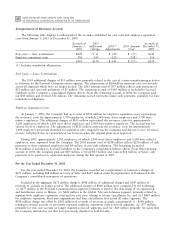

Reorganization of Businesses Accruals

The following table displays a rollforward of the accruals established for exit costs and employee separation

costs from January 1, 2004 to December 31, 2004:

Accruals at 2004 2004 Accruals at

January 1, Additional 2004(1) Amount December 31,

2004 Charges Adjustments Used 2004

Exit costsÌlease terminations $143 $Ì $(21) $ (38) $ 84

Employee separation costs 116 59 (34) (95) 46

$259 $59 $(55) $(133) $130

(1) Includes translation adjustments.

Exit CostsÌLease Terminations

At January 1, 2004, the Company had an accrual of $143 million for exit costs attributable to lease

terminations. The 2004 adjustments of $21 million represent reversals of $32 million for accruals no longer needed,

partially oÅset by an $11 million translation adjustment. The $38 million used in 2004 reÖects cash payments. The

remaining accrual of $84 million, which is included in Accrued Liabilities in the Company's consolidated balance

sheets, represents future cash payments for lease termination obligations.