Motorola 2004 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111

MOTOROLA INC. AND SUBSIDIARIES NOTES TO

CONSOLIDATED FINANCIAL STATEMENTS(Dollars in millions, except as noted)

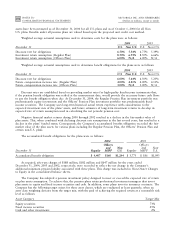

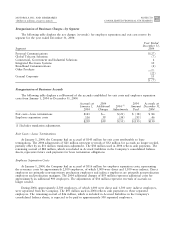

Total restricted stock and restricted stock units issued and outstanding at December 31, 2004 and 2003 were

6.0 million and 6.6 million, respectively. At December 31, 2004 and 2003, the amount of related deferred

compensation reÖected in Stockholders' Equity in the consolidated balance sheets was $36 million and $50 million,

respectively. Net additions to deferred compensation for both the years ended December 31, 2004 and 2003 were

$10 million. An aggregate of approximately 1.1 million, 2.5 million, and 1.7 million shares of restricted stock and

restricted stock units were granted in 2004, 2003 and 2002, respectively. The amortization of deferred

compensation for the years ended December 31, 2004, 2003 and 2002 was $24 million, $36 million and

$32 million, respectively.

Other BeneÑts

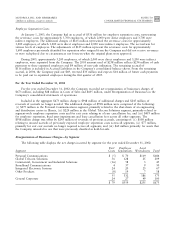

DeÑned Contribution Plans:

The Company and certain subsidiaries have various deÑned contribution plans, in

which all eligible employees participate. The Company generally makes two types of contributions to these plans,

matching contributions and proÑt sharing contributions.

In the U.S., the proÑt sharing and savings plan is a contributory plan. Matching contributions are based upon

the amount of the employees' contributions and do not depend on the Company's proÑts. EÅective January 1,

2005, newly hired employees will have a higher maximum matching contribution at 4% on the Ñrst 6% of employee

contributions, compared to 3% for employees hired prior to January 2005. ProÑt sharing contributions are generally

based upon pre-tax earnings, as deÑned, with an adjustment for the aggregate matching contribution. EÅective

January 1, 2005, the plan has been amended to exclude the proÑt-sharing component.

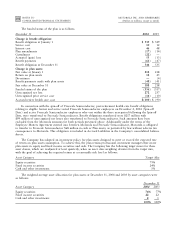

Company contributions, primarily relating to the employer match, to all plans for the years ended

December 31, 2004, 2003 and 2002 were $74 million, $67 million and $73 million, respectively. The proÑt sharing

contribution for the year ended December 31, 2004 was $69 million. There was no proÑt sharing contribution for

the years ended December 31, 2003 and 2002.

Motorola Incentive Plan:

The Motorola Incentive Plan provides eligible employees with an annual payment,

calculated as a percentage of an employee's eligible earnings, in the year after the close of the current calendar year

if speciÑed business goals are met. The provision for awards under these incentive plans for the years ended

December 31, 2004, 2003 and 2002 were $771 million, $422 million and $263 million, respectively.

Mid-Range Incentive Plan:

In 2003, the Long Range Incentive Program was replaced by the Mid-Range

Incentive Plan (MRIP). MRIP rewards participating elected oÇcers for the Company's achievement of outstanding

performance during the period, based on two performance objectives measured over two-year cycles. The provision

for MRIP for the years ended December 31, 2004 and 2003 was $56 million and $5 million, respectively. Prior to

2003, the Company's Long Range Incentive Program of 1994 rewarded participating elected oÇcers for the

Company's achievement of outstanding long-range performance, based on four performance objectives measured

over four-year cycles. There was no provision for the year ended December 31, 2002.

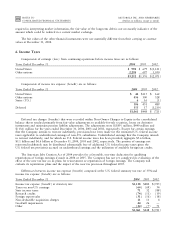

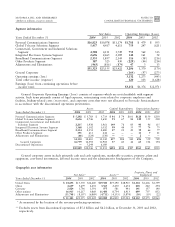

8. Financing Arrangements

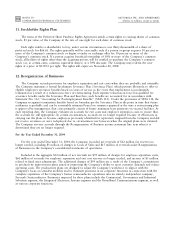

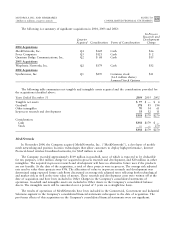

Finance receivables consist of the following:

December 31

2004

2003

Gross Ñnance receivables $ 2,136 $ 2,396

Less allowance for losses (1,966) (2,095)

170 301

Less current portion (83) (92)

Long-term Ñnance receivables $87$ 209

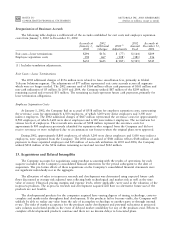

Current Ñnance receivables are included in Accounts Receivable and long-term Ñnance receivables are included

in Other Assets in the Company's consolidated balance sheets. Interest income recognized on Ñnance receivables for

the years ended December 31, 2004, 2003 and 2002 was $9 million, $18 million and $28 million, respectively.