Motorola 2004 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

For the full year 2003, the segment recorded net charges of $67 million related to reorganization of businesses

and other charges. These charges primarily consisted of: (i) a $73 million charge for impairment of goodwill

related to the infrastructure business, partially oÅset by a reduction in accruals no longer needed, primarily related

to segment-wide employee severance costs.

For the full year 2002, the segment recorded net charges of $369 million related to reorganization of

businesses and other charges. These charges primarily consisted of: (i) a $325 million intangible asset impairment

charge relating to a license to certain intellectual property that enables the Company to provide national

authorization services for digital set-top terminals, (ii) a $37 million net charge for segment-wide employee

separation costs, and (iii) an $11 million charge for in-process research and development related to the acquisition

of Synchronous, Inc., partially oÅset by the recognition of a pension curtailment gain of $13 million related to the

General Instrument pension plan.

Other

Other is comprised of the Other Products segment and general corporate items. The Other Products segment

includes: (i) various corporate programs representing developmental businesses and research and development

projects that are not included in any major segment, and (ii) Motorola Credit Corporation, the Company's wholly-

owned Ñnance subsidiary.

In January 2004, a decision was made to realign the operations of Next Level Communications, Inc. (""Next

Level''), a wholly-owned subsidiary of Motorola, within BCS. The Ñnancial results of Next Level have been

reclassiÑed from the Other Products segment to BCS for all periods presented.

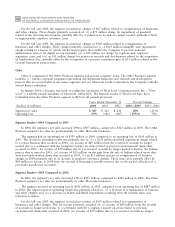

Years Ended December 31 Percent Change

(Dollars in millions)

2004

2003 2002

2004Ì2003

2003Ì2002

Segment net sales $ 387 $ 323 $ 430 20% (25)%

Operating loss (393) (141) (487) (179)% 71%

Segment ResultsÌ2004 Compared to 2003

In 2004, the segment's net sales increased 20% to $387 million, compared to $323 million in 2003. The Other

Products segment's net sales are predominantly to other Motorola businesses.

The segment had an operating loss of $393 million in 2004, compared to an operating loss of $141 million in

2003. The decline in operating results was primarily due to: (i) a $125 million goodwill impairment charge related

to a sensor business that occurred in 2004, (ii) income of $69 million from the reversal of accruals no longer

needed due to a settlement with the Company's insurer on items related to previous environmental claims that

occurred in 2003, (iii) income of $59 million due to a reversal of accruals no longer needed related to the Iridium

project that occurred in 2003, (iv) income of $33 million on the gain from the sale of Iridium-related assets that

were previously written down that occurred in 2003, (v) an $11 million increase in reorganization of business

charges in 2004, primarily due to an increase in employee severance charges. These items were partially oÅset by

$44 million in income in 2004 from the reversal of Ñnancing receivable reserves due to the partial collection of a

previously-uncollected receivable.

Segment ResultsÌ2003 Compared to 2002

In 2003, the segment's net sales decreased 25% to $323 million, compared to $430 million in 2002. The Other

Products segment's net sales are predominantly to other Motorola businesses.

The segment incurred an operating loss of $141 million in 2003, compared to an operating loss of $487 million

in 2002. The improvement in operating results was primarily related to: (i) a decrease in reorganization of business

and other charges, and (ii) a decrease in SG&A and R&D expenditures resulting from the beneÑts from cost-

reduction activities.

For the full year 2003, the segment recorded net income of $151 million related to reorganization of

businesses and other charges. This net income primarily consisted of: (i) income of $69 million from the reversal

of accruals no longer needed due to a settlement with the Company's insurer on items related to previous

environmental claims that occurred in 2003, (ii) income of $59 million due to a reversal of accruals no longer