Motorola 2004 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

MOTOROLA INC. AND SUBSIDIARIES NOTES TO

CONSOLIDATED FINANCIAL STATEMENTS(Dollars in millions, except as noted)

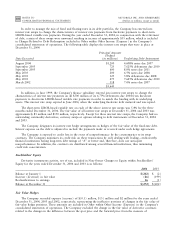

4. Debt and Credit Facilities

Long-Term Debt

December 31

2004

2003

6.75% debentures due 2004 $Ì$ 500

6.5% debentures due 2025 (puttable in 2005) 398 398

6.75% debentures due 2006 Ì1,399

7.6% notes due 2007 118 300

4.608% senior notes due 2007 1,219 Ì

6.5% senior notes due 2007 Ì1,200

6.5% notes due 2008 200 200

5.8% debentures due 2008 324 324

7.625% debentures due 2010 1,193 1,192

8.0% notes due 2011 598 598

7.5% debentures due 2025 398 398

6.5% debentures due 2028 295 405

5.22% debentures due 2097 193 192

Other long-term debt 42 122

4,978 7,228

Less: current maturities (400) (555)

Long-term debt $4,578 $6,673

Short-Term Debt

December 31

2004

2003

Notes to banks $17 $10

Commercial paper 300 304

317 314

Add: Current maturities 400 555

Notes payable and current portion of long-term debt $717 $869

Weighted average interest rates on short-term borrowings

Commercial paper 1.6% 1.3%

Other short-term debt 3.3% 4.8%

In August 2004, the Company completed the open market purchase of $110 million of the $409 million

aggregate principal amount outstanding of its 6.50% Debentures due 2028 (the ""2028 Debentures''). The

$110 million principal amount of 2028 Debentures was purchased for an aggregate purchase price of approximately

$115 million.

In August 2004, pursuant to the terms of the 7.00% Equity Security Units (the ""MEUs''), the $1.2 billion of

6.50% Senior Notes due 2007 (the ""2007 MEU Notes'') that comprised a portion of the MEUs were remarketed

to a new set of holders. In connection with the remarketing, the interest rate on the 2007 MEU Notes was reset to

4.608%. None of the other terms of the 2007 MEU Notes were changed. Shortly after the remarketing, the

Company entered into interest rate swaps to change the characteristics of the interest rate payments from Ñxed-rate

payments to short-term LIBOR-based variable rate payments. Additionally, in November 2004, pursuant to the

terms of the MEUs, the Company sold 69.4 million shares of common stock to the holders of the MEUs. The

purchase price per share was $17.30 resulting in aggregate proceeds of $1.2 billion.

In July 2004, the Company commenced a cash tender oÅer for any and all of the $300 million aggregate

principal amount outstanding of its 7.60% Notes due 2007 (the ""2007 Notes''). The tender oÅer expired in August

2004 and an aggregate principal amount of approximately $182 million of 2007 Notes was validly tendered. In

August 2004, the Company repurchased the validly tendered 2007 Notes for an aggregate purchase price of

approximately $202 million. This debt was repurchased with proceeds distributed to the Company by Freescale

Semiconductor.