Motorola 2004 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

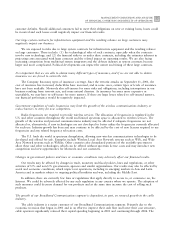

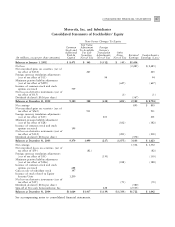

87CONSOLIDATED FINANCIAL STATEMENTS

Motorola, Inc. and Subsidiaries

Consolidated Statements of Stockholders' Equity

Non-Owner Changes To Equity

Fair Value

Common Adjustment Foreign

Stock and To Available Currency

Additional For Sale Translation Other

Paid-In Securities, Adjustments, Items, Retained Comprehensive

(In millions, except per share amounts) Capital Net of Tax Net of Tax Net of Tax Earnings Earnings (Loss)

Balances at January 1, 2002 $ 8,471 $ 343 $(512) $ (45) $5,434

Net loss (2,485) $(2,485)

Net unrealized gains on securities (net of

tax eÅect of $152) 245 245

Foreign currency translation adjustments

(net of tax eÅect of $11) 94 94

Minimum pension liability adjustment

(net of tax eÅect of $299) (647) (647)

Issuance of common stock and stock

options exercised 709

Net loss on derivative instruments (net of

tax eÅect of $0.5) (1) (1)

Dividends declared ($0.16 per share) (367)

Balances at December 31, 2002 9,180 588 (418) (693) 2,582 $(2,794)

Net earnings 893 $ 893

Net unrealized gains on securities (net of

tax eÅect of $565) 911 911

Foreign currency translation adjustments

(net of tax eÅect of $15) 201 201

Minimum pension liability adjustment

(net of tax eÅect of $28) (182) (182)

Issuance of common stock and stock

options exercised 199

Net loss on derivative instruments (net of

tax eÅect of $112) (200) (200)

Dividends declared ($0.16 per share) (372)

Balances at December 31, 2003 9,379 1,499 (217) (1,075) 3,103 $ 1,623

Net earnings 1,532 $ 1,532

Net unrealized losses on securities (net of

tax eÅect of $59) (82) (82)

Foreign currency translation adjustments

(net of tax eÅect of $35) (150) (150)

Minimum pension liability adjustment

(net of tax eÅect of $126) (188) (188)

Issuance of common stock and stock

options exercised 688

Gain on sale of subsidiary stock 397

Issuance of stock related to Equity

Security Units 1,200

Net loss on derivative instruments (net of

tax eÅect of $39) (70) (70)

Dividends declared ($0.16 per share) (380)

Spin-oÅ of Freescale Semiconductor, Inc. 228 (2,533)

Balances at December 31, 2004 $11,664 $1,417 $(139) $(1,333) $1,722 $ 1,042

See accompanying notes to consolidated Ñnancial statements.