Motorola 2004 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94 MOTOROLA INC. AND SUBSIDIARIESNOTES TO

CONSOLIDATED FINANCIAL STATEMENTS (Dollars in millions, except as noted)

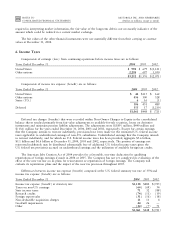

Earnings (Loss) Per Common Share

The following table presents the computation of the basic and diluted earnings (loss) per common share from

both continuing operations and net earnings, which includes discontinued operations:

Continuing Operations Net Earnings

Years ended December 31

2004

2003 2002

2004

2003 2002

Basic earnings (loss) per common share:

Earnings (loss) $ 2,191 $ 928 $ (1,350) $ 1,532 $ 893 $ (2,485)

Weighted average common shares outstanding 2,365.0 2,321.9 2,282.3 2,365.0 2,321.9 2,282.3

Per share amount $ 0.93 $ 0.40 $ (0.59) $ 0.65 $ 0.38 $ (1.09)

Diluted earnings (loss) per common share:

Earnings (loss) $ 2,191 $ 928 $ (1,350) $ 1,532 $ 893 $ (2,485)

Add: Interest on equity security units, net 42 ÌÌ42 ÌÌ

Earnings (loss), as adjusted $ 2,233 $ 928 $ (1,350) $ 1,574 $ 893 $ (2,485)

Weighted average common shares outstanding 2,365.0 2,321.9 2,282.3 2,365.0 2,321.9 2,282.3

Add eÅect of dilutive securities:

Stock options/restricted stock 48.8 26.7 Ì 48.8 26.7 Ì

Equity security units 57.8 ÌÌ57.8 ÌÌ

Zero coupon notes due 2009 and 2013 0.4 2.6 Ì 0.4 2.6 Ì

Diluted weighted average common shares

outstanding 2,472.0 2,351.2 2,282.3 2,472.0 2,351.2 2,282.3

Per share amount $ 0.90 $ 0.39 $ (0.59) $ 0.64 $ 0.38 $ (1.09)

In the computation of diluted earnings per common share from both continuing operations and on a net

earnings basis for the year ended December 31, 2004, the assumed conversion of 155.8 million stock options were

excluded because their inclusions would have been antidilutive. In the computation of diluted earnings per common

share from both continuing operations and on a net earnings basis for the year ended December 31, 2003, the

assumed conversions of the zero coupon notes due 2009, equity security units and 200.9 million stock options were

excluded because their inclusions would have been antidilutive. In the computation of diluted loss per common

share from both continuing operations and on a net earnings basis for the year ended December 31, 2002, the

assumed conversions of the zero coupon notes due 2009 and 2013, all stock options, restricted stock, warrants, and

equity security units were excluded because their inclusion would have been antidilutive.

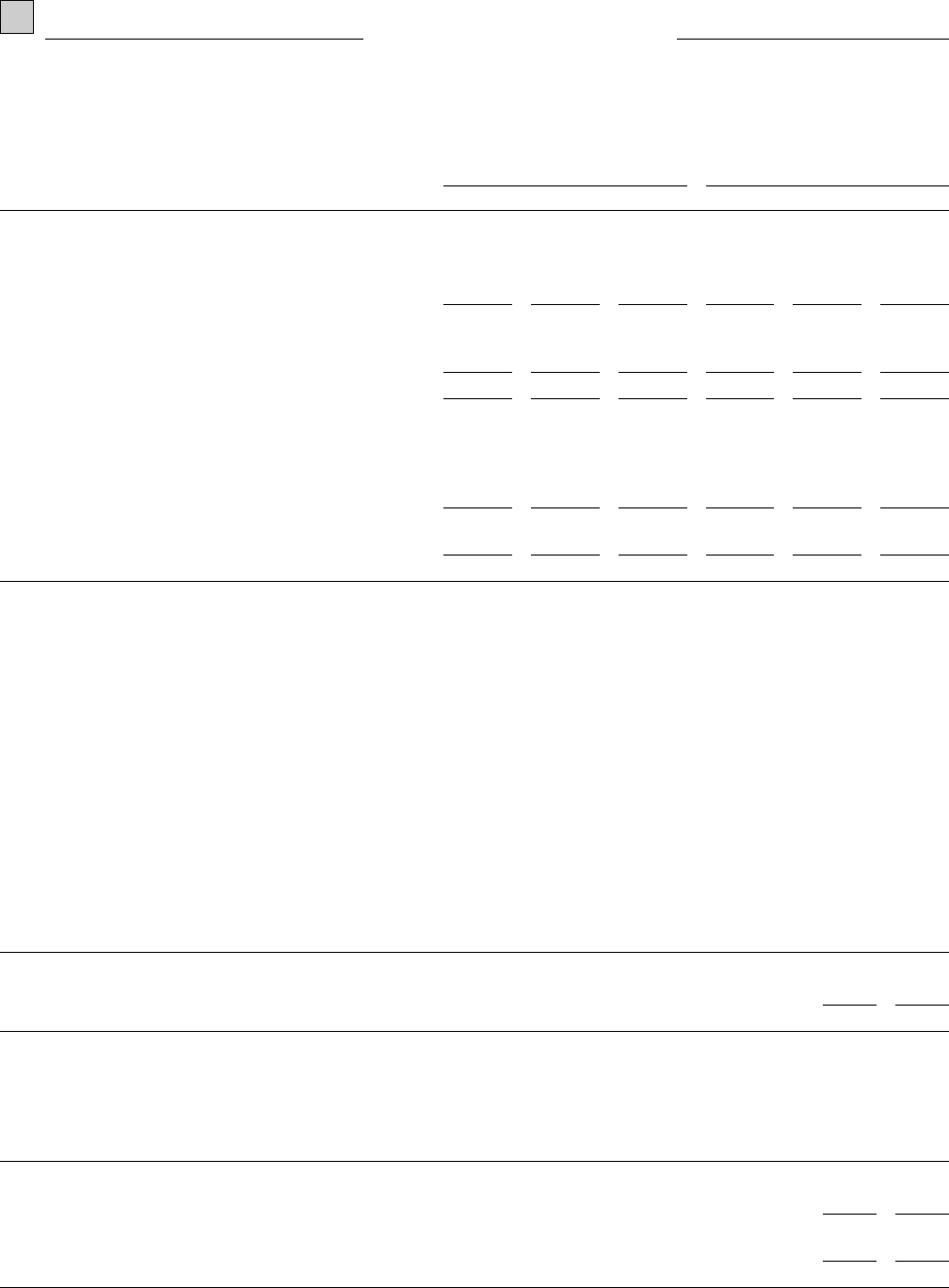

Balance Sheet Information

Accounts Receivable

Accounts Receivable, net, consists of the following:

December 31

2004

2003

Accounts receivable $4,674 $4,046

Less allowance for doubtful accounts (182) (224)

$4,492 $3,822

Inventories

Inventories, net, consist of the following:

December 31

2004

2003

Finished goods $1,429 $ 830

Work-in-process and production materials 1,665 1,861

3,094 2,691

Less inventory reserves (548) (592)

$2,546 $2,099