Motorola 2004 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104 MOTOROLA INC. AND SUBSIDIARIESNOTES TO

CONSOLIDATED FINANCIAL STATEMENTS (Dollars in millions, except as noted)

material adverse eÅect on the Company's consolidated Ñnancial position, liquidity or results of operations in the

period in which the matter is ultimately resolved.

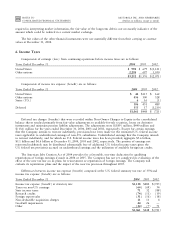

7. Employee BeneÑt and Incentive Plans

Pension BeneÑts

The Company's noncontributory pension plan (the Regular Pension Plan) covers most U.S. employees who

become eligible after one year of service. The beneÑt formula is dependent upon employee earnings and years of

service. EÅective January 1, 2005, newly-hired employees will not be eligible to participate in the Regular Pension

Plan.

The Company has a noncontributory supplemental retirement beneÑt plan (the OÇcers' Plan) for its elected

oÇcers. The OÇcers' Plan contains provisions for funding the participants' expected retirement beneÑts when the

participants meet the minimum age and years of service requirements. Elected oÇcers who were not yet vested in

the OÇcers' Plan as of December 31, 1999 had the option to remain in the OÇcers' Plan or elect to have their

beneÑt bought out in restricted stock units. EÅective December 31, 1999, no new elected oÇcers were eligible to

participate in the OÇcers' Plan.

The Company has an additional noncontributory supplemental retirement beneÑt plan (the Motorola

Supplemental Pension PlanÌMSPP), which provides supplemental beneÑts, to certain employees, in excess of the

limitations imposed by the Internal Revenue Code on the Regular Pension Plan. Elected oÇcers covered under the

OÇcers' Plan or who participated in the restricted stock buy-out are not eligible to participate in MSPP. EÅective

January 1, 2005, newly-hired employees will not be eligible to participate in MSPP.

The Company also provides deÑned beneÑt plans to employees of some of its foreign entities. The information

below for Non U.S. plans covers the Company's principal foreign plans; any other plans are not signiÑcant to the

Company either individually or in the aggregate.

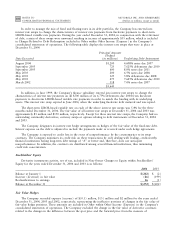

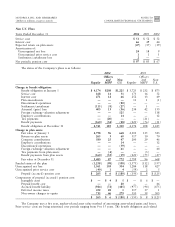

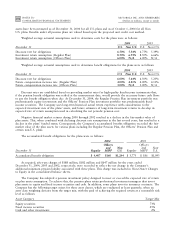

The net periodic pension cost for the regular pension plan, oÇcers' plan, MSPP and Non U.S. plans was as

follows:

Regular Pension Plan

Years Ended December 31

2004

2003 2002

Service cost $ 168 $ 173 $ 165

Interest cost 271 252 231

Expected return on plan assets (286) (281) (303)

Amortization of:

Unrecognized net loss 33 ÌÌ

Unrecognized prior service cost (7) (7) (8)

Settlement/curtailment gain (12) Ì (13)

Net periodic pension cost $ 167 $ 137 $ 72

OÇcers' Plan and MSPP

Years Ended December 31

2004

2003 2002

Service cost $14 $16 $21

Interest cost 12 13 15

Expected return on plan assets (3) (4) (5)

Amortization of:

Unrecognized net loss 755

Unrecognized prior service cost 112

Settlement/curtailment loss 14 16 44

Net periodic pension cost $45 $47 $82