Motorola 2004 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

MOTOROLA INC. AND SUBSIDIARIES NOTES TO

CONSOLIDATED FINANCIAL STATEMENTS(Dollars in millions, except as noted)

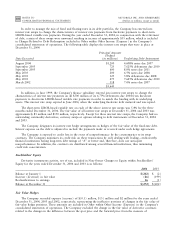

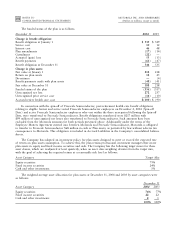

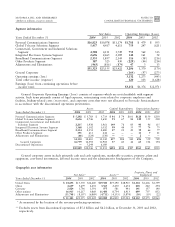

Non U.S. Plans

Years Ended December 31

2004

2003 2002

Service cost $51 $52 $52

Interest cost 66 49 44

Expected return on plan assets (47) (37) (39)

Amortization of:

Unrecognized net loss 24 18 9

Unrecognized prior service cost 111

Settlement/curtailment loss 2ÌÌ

Net periodic pension cost $97 $83 $67

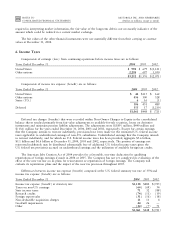

The status of the Company's plans is as follows:

2004

2003

OÇcers

OÇcers

and Non

and Non

Regular MSPP U.S.

Regular MSPP U.S.

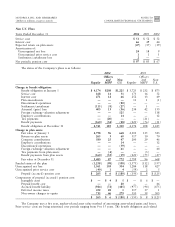

Change in beneÑt obligation:

BeneÑt obligation at January 1 $ 4,174 $208 $1,225 $ 3,725 $ 232 $ 873

Service cost 168 14 51 173 16 52

Interest cost 271 12 66 252 13 49

Plan amendments ÌÌ Ì 11 1 (1)

Discontinued operations Ì Ì (80) ÌÌ Ì

Settlement/curtailment (115) (8) (27) Ì1Ì

Actuarial (gain) loss 403 13 (36) 234 42 153

Foreign exchange valuation adjustment Ì Ì 125 Ì Ì 118

Employee contributions ÌÌ 14 ÌÌ 12

Tax payments Ì (20) Ì Ì (21) Ì

BeneÑt payments (160) (34) (28) (221) (76) (31)

BeneÑt obligation at December 31 4,741 185 1,310 4,174 208 1,225

Change in plan assets:

Fair value at January 1 2,798 96 668 2,303 135 523

Return on plan assets 265 3 60 517 10 70

Company contributions 580 25 47 200 29 46

Employee contributions ÌÌ 14 ÌÌ 12

Discontinued operations Ì Ì (59) ÌÌ Ì

Foreign exchange valuation adjustment ÌÌ 61 ÌÌ 44

Tax payments from plan assets Ì (4) Ì Ì (3) Ì

BeneÑt payments from plan assets (160) (33) (19) (221) (75) (27)

Fair value at December 31 3,483 87 772 2,799 96 668

Funded status of the plan (1,258) (98) (538) (1,375) (112) (557)

Unrecognized net loss 1,561 103 354 1,284 118 427

Unrecognized prior service cost (40) 1 4 (59) 2 5

Prepaid (accrued) pension cost $ 263 $ 6 $ (180) $ (150) $ 8 $ (125)

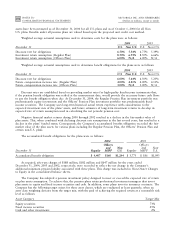

Components of prepaid (accrued) pension cost:

Intangible asset $Ì$4$5$Ì$6$Ì

Prepaid beneÑt cost ÌÌ 20 ÌÌ 46

Accrued beneÑt liability (924) (72) (485) (977) (94) (475)

Deferred income taxes 452 28 1 317 37 1

Non-owner changes to equity 735 46 279 510 59 303

$ 263 $ 6 $ (180) $ (150) $ 8 $ (125)

The Company uses a Ñve year, market-related asset value method of amortizing asset-related gains and losses.

Prior service costs are being amortized over periods ranging from 9 to 15 years. The beneÑt obligation and related