Motorola 2004 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

MOTOROLA INC. AND SUBSIDIARIES NOTES TO

CONSOLIDATED FINANCIAL STATEMENTS(Dollars in millions, except as noted)

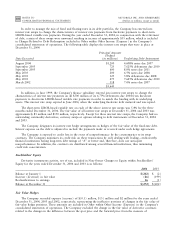

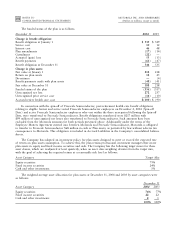

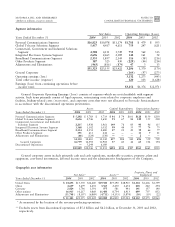

The weighted-average pension plan asset allocation at December 31, 2004 and 2003 by asset categories was as

follows:

December 31,

Asset Category

2004

2003

Equity securities 73% 73%

Fixed income securities 25 25

Cash and other investments 22

100% 100%

Within the equity securities asset class, the investment policy provides for investments in a broad range of

publicly-traded securities including both domestic and international stocks. Within the Ñxed income securities asset

class, the investment policy provides for investments in a broad range of publicly-traded debt securities ranging

from US Treasury issues, corporate debt securities, mortgages and asset-backed issues, as well as international debt

securities. In the cash and other investments asset class, investments may be in cash, cash equivalents or insurance

contracts.

The Company expects to make cash contributions of approximately $150 million to its U.S. pension plans and

$45 million to its Non-U.S. pension plans in 2005.

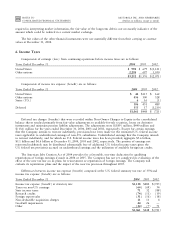

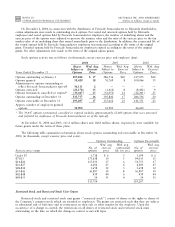

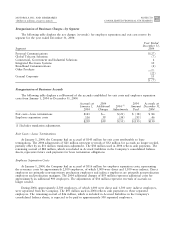

The following beneÑt payments, which reÖect expected future service, as appropriate, are expected to be paid

as follows:

U.S.

Pension Non

Year Plans U.S.

2005 $ 188 $ 24

2006 195 24

2007 205 27

2008 236 30

2009 242 33

2010-2014 1,486 232

Postretirement Health Care BeneÑts

Certain health care beneÑts are available to eligible domestic employees meeting certain age and service

requirements upon termination of employment. For eligible employees hired prior to January 1, 2002, the Company

oÅsets a portion of the postretirement medical costs to the retired participant. EÅective January 1, 2005, newly

hired employees will not be eligible to participate in this plan.

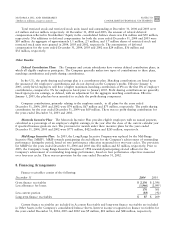

The assumptions used were as follows:

December 31

2004

2003

Discount rate for obligations 6.00% 6.50%

Investment return assumptions 8.50% 8.50%

Net retiree health care expenses were as follows:

Years Ended December 31

2004

2003 2002

Service cost $10 $12 $14

Interest cost 46 48 48

Expected return on plan assets (21) (25) (30)

Amortization of:

Unrecognized net loss 14 11 7

Unrecognized prior service cost (4) (3) (1)

Settlement/curtailment gain (6) ÌÌ

Net retiree health care expense $39 $43 $38