Motorola 2004 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100 MOTOROLA INC. AND SUBSIDIARIESNOTES TO

CONSOLIDATED FINANCIAL STATEMENTS (Dollars in millions, except as noted)

In order to manage the mix of Ñxed and Öoating rates in its debt portfolio, the Company has entered into

interest rate swaps to change the characteristics of interest rate payments from Ñxed-rate payments to short-term

LIBOR-based variable rate payments. During the year ended December 31, 2004, in conjunction with the retirement

of debt, certain of these swaps were unwound resulting in income of approximately $55 million, which is included

in Charges Related to Debt Redemption included in Other within Other Income (Expense) in the Company's

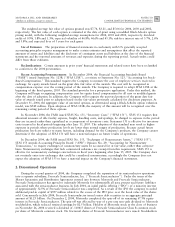

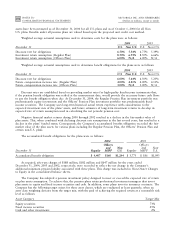

consolidated statements of operations. The following table displays the interest rate swaps that were in place at

December 31, 2004:

Principal Amount

Hedged

Date Executed (in millions) Underlying Debt Instrument

August 2004 $1,200 4.608% notes due 2007

September 2003 725 7.625% debentures due 2010

September 2003 600 8.0% notes due 2011

May 2003 200 6.5% notes due 2008

May 2003 325 5.8% debentures due 2008

May 2003 475 7.625% debentures due 2010

March 2002 118 7.6% notes due 2007

$3,643

In addition, in June 1999, the Company's Ñnance subsidiary entered into interest rate swaps to change the

characteristics of interest rate payments on all $500 million of its 6.75% Debentures due 2004 from Ñxed-rate

payments to short-term LIBOR-based variable rate payments in order to match the funding with its underlying

assets. This interest rate swap expired in June 2004, when the underlying Ñxed-rate debt matured and was repaid.

The short-term LIBOR-based variable rate on each of the above interest rate swaps was 5.4% for the three

months ended December 31, 2004. The fair value of all interest rate swaps at December 31, 2004 and 2003 was

approximately $3 million and $150 million, respectively. Except for these interest rate swaps, the Company had no

outstanding commodity derivatives, currency swaps or options relating to debt instruments at December 31, 2004

and 2003.

The Company designates its interest rate hedge arrangements as hedges of the fair value of the Ñxed-rate debt.

Interest expense on the debt is adjusted to include the payments made or received under such hedge agreements.

The Company is exposed to credit loss in the event of nonperformance by the counterparties to its swap

contracts. The Company minimizes its credit risk on these transactions by only dealing with leading, credit-worthy

Ñnancial institutions having long-term debt ratings of ""A'' or better and, therefore, does not anticipate

nonperformance. In addition, the contracts are distributed among several Ñnancial institutions, thus minimizing

credit risk concentration.

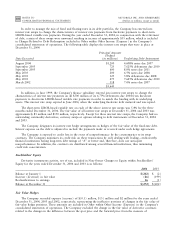

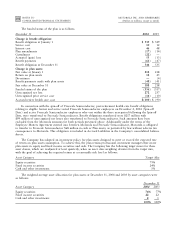

Stockholders' Equity

Derivative instruments activity, net of tax, included in Non-Owner Changes to Equity within Stockholders'

Equity for the years ended December 31, 2004 and 2003 is as follows:

2004

2003

Balance at January 1 $(202) $ (2)

Increase (decrease) in fair value (86) (199)

ReclassiÑcations to earnings 16 (1)

Balance at December 31 $(272) $(202)

Fair Value Hedges

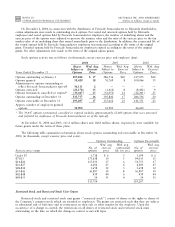

The Company recorded expense (income) of $(0.1) million, $(3) million and $2 million for the years ended

December 31, 2004, 2003 and 2002, respectively, representing the ineÅective portions of changes in the fair value of

fair value hedge positions. These amounts are included in Other within Other Income (Expense) in the Company's

consolidated statements of operations. The Company excluded the change in the fair value of derivative contracts

related to the changes in the diÅerence between the spot price and the forward price from the measure of