Motorola 2004 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

$1.4 Billion of 6.75% Debentures due 2006: In July 2004, the Company called for the redemption of all

$1.4 billion aggregate principal amount outstanding of its 2006 Debentures. All of the 2006 Debentures were

redeemed in August 2004 for an aggregate purchase price of approximately $1.5 billion. This debt was redeemed

partially with proceeds distributed to the Company by Freescale Semiconductor and partially with available cash

balances.

$110 Million of 6.50% Debentures due 2028: In August 2004, the Company completed the open market

purchase of $110 million of the $409 million aggregate principal amount outstanding of its 2028 Debentures. The

$110 million principal amount of 2028 Debentures was purchased for an aggregate purchase price of approximately

$115 million.

Given the Company's cash position, it may from time to time seek to opportunistically retire certain of its

outstanding debt through open market cash purchases, privately-negotiated transactions or otherwise. Such

repurchases, if any, will depend on prevailing market conditions, the Company's liquidity requirements, contractual

restrictions and other factors.

$1.2 Billion of Proceeds from the Sale of Stock Pursuant to Equity Security Units During 2004: The

Company sold $1.2 billion of MEUs during the fourth quarter of 2001. In November 2004, pursuant to the terms

of the MEUs the Company sold 69.4 million shares of common stock for $1.2 billion to the holders of the MEUs.

Pursuant to the terms of the MEUs, the price per share paid by the holders of the MEUs was based on the

applicable market value of the Company's common stock at the purchase date. The purchase price was $17.30 per

share, resulting in the holders purchasing 2.8902 shares of common stock per MEU, for a total of 69.4 million

shares.

Credit Ratings: Three independent credit rating agencies, Standard & Poor's (""S&P''), Moody's Investor

Services (""Moody's'') and Fitch Investors Service (""Fitch''), assign ratings to the Company's short-term and long-

term debt.

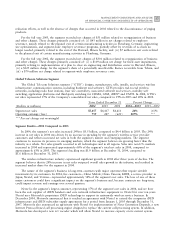

The following chart reÖects the current ratings assigned to the Company's senior unsecured non-credit

enhanced long-term debt and the Company's commercial paper by each of these agencies:

Long-Term Debt Commercial Date of Last

Name of Rating Agency Rating Outlook Paper Action

S&P BBB positive A-2 August 2, 2004

Moody's Baa3 positive P-3 July 21, 2004

Fitch BBB° positive F-2 January 20, 2005

In January 2005, Fitch upgraded the Company's long-term debt rating to ""BBB°'' with a ""positive'' outlook

from ""BBB'' with a ""positive'' outlook. There was no change in the short-term rating of ""F-2''. In August 2004

S&P changed its outlook on the Company's long-term debt to ""BBB'' with a ""positive'' outlook from ""BBB'' with

a ""negative'' outlook. There was no change in the short-term rating of ""A-2.'' In July 2004, Moody's changed its

outlook on the Company's long-term debt to ""Baa3'' with a ""positive'' outlook from ""Baa3'' with a ""negative''

outlook. There was no change in the short-term rating of ""P-3.''

The Company's debt ratings are considered ""investment grade.'' If the Company's senior long-term debt were

rated lower than ""BBB-'' by S&P or Fitch or ""Baa3'' by Moody's (which would be a decline of one level from

current Moody's ratings), the Company's long-term debt would no longer be considered ""investment grade.'' If this

were to occur, the terms on which the Company could borrow money would become more onerous. The Company

would also have to pay higher fees related to its domestic revolving credit facility. The Company has never

borrowed under its domestic revolving credit facilities.

The Company continues to have access to the commercial paper and long-term debt markets. However, the

Company generally has had to pay a higher interest rate to borrow money than it would have if its credit ratings

were higher. The Company has greatly reduced the amount of its commercial paper outstanding in comparison to

historical levels and has maintained commercial paper balances of between $300 million and $500 million for the

last 4 years. This reÖects the fact that the market for commercial paper rated ""A-2/P-3/F-2'' is much smaller than

that for commercial paper rated ""A-1/P-1/F-1'' and commercial paper or other short-term borrowings may be of

limited availability to participants in the ""A-2/P-3/F-2'' market from time-to-time or for extended periods.