Motorola 2004 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108 MOTOROLA INC. AND SUBSIDIARIESNOTES TO

CONSOLIDATED FINANCIAL STATEMENTS (Dollars in millions, except as noted)

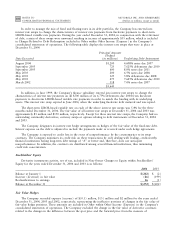

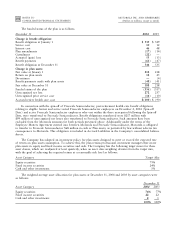

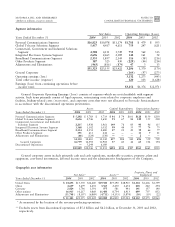

The funded status of the plan is as follows.

December 31

2004

2003

Change in beneÑt obligation:

BeneÑt obligation at January 1 $ 535 $ 549

Service cost 10 12

Interest cost 46 48

Plan amendments (17) (14)

Curtailment (22) Ì

Actuarial (gain) loss 53 (13)

BeneÑt payments (61) (47)

BeneÑt obligation at December 31 544 535

Change in plan assets:

Fair value at January 1 218 218

Return on plan assets 18 45

Divestitures Ì(4)

BeneÑt payments made with plan assets (48) (41)

Fair value at December 31 188 218

Funded status of the plan (356) (317)

Unrecognized net loss 272 237

Unrecognized prior service cost (16) (10)

Accrued retiree health care cost $(100) $ (90)

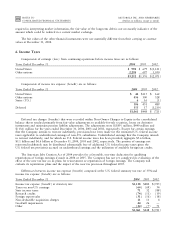

In connection with the spin-oÅ of Freescale Semiconductor, post-retirement health care beneÑt obligations

relating to eligible former and active vested Freescale Semiconductor employees on December 2, 2004 (Spin-oÅ

Date) and active Freescale Semiconductor employees who vest within the three year period following the Spin-oÅ

Date, were transferred to Freescale Semiconductor. BeneÑt obligations transferred were $217 million with

$99 million of unrecognized net losses also transferred to Freescale Semiconductor. Such amounts have been

excluded from the Motorola amounts for both periods presented above. Additionally under the terms of the

Employee Matters Agreement entered into between Motorola and Freescale Semiconductor, Motorola is obligated

to transfer to Freescale Semiconductor $68 million in cash or Plan assets, as permitted by law without adverse tax

consequences to Motorola. This obligation is included in Accrued Liabilities in the Company's consolidated balance

sheets.

The Company has adopted an investment policy for plan assets designed to meet or exceed the expected rate

of return on plan assets assumption. To achieve this, the plan retains professional investment managers that invest

plan assets in equity and Ñxed income securities and cash. The Company has the following target mixes for these

asset classes, which are readjusted at least quarterly, when an asset class weighting deviates from the target mix,

with the goal of achieving the required return at a reasonable risk level as follows:

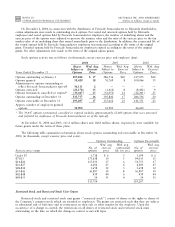

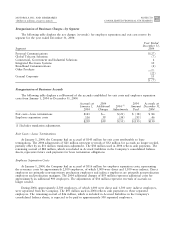

Asset Category Target Mix

Equity securities 75%

Fixed income securities 24%

Cash and other investments 1%

The weighted-average asset allocation for plan assets at December 31, 2004 and 2003 by asset categories were

as follows:

December 31

Asset Category

2004

2003

Equity securities 76% 77%

Fixed income securities 22 22

Cash and other investments 21

100% 100%