Motorola 2004 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124 MOTOROLA INC. AND SUBSIDIARIESNOTES TO

CONSOLIDATED FINANCIAL STATEMENTS (Dollars in millions, except as noted)

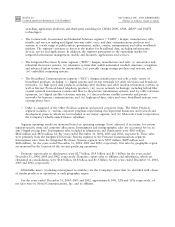

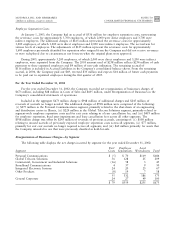

January 1, December 31,

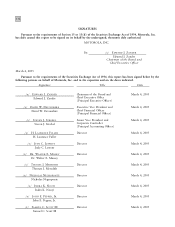

Segment 2003 Acquired Adjustments 2003

Personal Communications $ 23 $ Ì $ (6) $ 17

Global Telecom Solutions 4 93 Ì 97

Commercial, Government and Industrial Solutions 123 Ì Ì 123

Integrated Electronic Systems 63 8 Ì 71

Broadband Communications 836 24 (78) 782

Other Products 125 Ì Ì 125

$1,174 $125 $(84) $1,215

The goodwill impairment test is performed at the reporting unit level and is a two-step analysis. First, the fair

value (FV) of the reporting unit is compared to its book value. If the FV of the reporting unit is less than its book

value, the Company performs a hypothetical purchase price allocation based on the reporting unit's fair value to

determine the fair value of the reporting unit's goodwill. Fair value is determined with the help of independent

appraisal Ñrms using a combination of present value techniques and quoted market prices of comparable businesses.

For the year ended December 31, 2004 the Company determined that goodwill related to a sensor group within the

Other Products segment was impaired by a total of $125 million. For the year ended December 31, 2003 the

Company determined that goodwill at the infrastructure reporting unit of the Broadband Communications segment

was impaired by $73 million. No impairment charges were required for the year ended December 31, 2002.

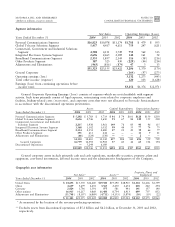

14. Valuation and Qualifying Accounts

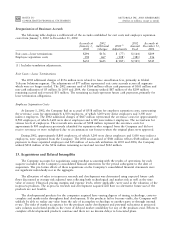

The following table presents the valuation and qualifying account activity for the years ended December 31,

2004, 2003 and 2002:

Balance at Charged to Balance at

January 1 Expense Used Adjustments(1)December 31

2004

Reorganization of Businesses $ 259 $ 59 $(133) $ (55) $ 130

Allowance for Doubtful Accounts 224 47 (28) (61) 182

Allowance for Losses on Finance Receivables 2,095 2 (69) (62) 1,966

Warranty Reserves 359 648 (387) (120) 500

Customer Reserves 584 2,594 (2,036) (318) 824

2003

Reorganization of Businesses 545 174 (315) (145) 259

Allowance for Doubtful Accounts 234 51 (23) (38) 224

Allowance for Losses on Finance Receivables 2,251 33 (160) (29) 2,095

Warranty Reserves 309 319 (178) (91) 359

Customer Reserves 539 844 (731) (68) 584

2002

Reorganization of Businesses 652 623 (545) (185) 545

Allowance for Doubtful Accounts 214 82 (34) (28) 234

Allowance for Losses on Finance Receivables 1,647 642 (38) Ì 2,251

Warranty Reserves 306 311 (289) (19) 309

Customer Reserves 400 737 (475) (123) 539

(1) Includes translation adjustments.