Motorola 2004 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

MOTOROLA INC. AND SUBSIDIARIES NOTES TO

CONSOLIDATED FINANCIAL STATEMENTS(Dollars in millions, except as noted)

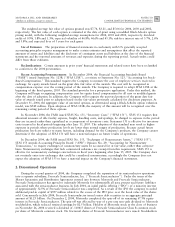

eÅectiveness as these amounts are charged to Other within Other Income (Expense) in the Company's consolidated

statements of operations. Expense (income) related to fair value hedges that were discontinued for the years ended

December 31, 2004, 2003 and 2002 are included in the amounts noted above.

Cash Flow Hedges

The Company recorded expense (income) of $11.9 million, $(1.5) million and $(0.1) million for the years

ended December 31, 2004, 2003 and 2002, respectively, representing the ineÅective portions of changes in the fair

value of cash Öow hedge positions. These amounts are included in Other within Other Income (Expense) in the

Company's consolidated statements of operations. The Company excluded the change in the fair value of derivative

contracts related to the changes in the diÅerence between the spot price and the forward price from the measure of

eÅectiveness as these amounts are charged to Other within Other Income (Expense) in the Company's consolidated

statements of operations. Expense (income) related to cash value hedges that were discontinued for the years

ended December 31, 2004, 2003 and 2002 are included in the amounts noted above.

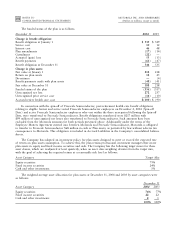

During the years ended December 31, 2004, 2003 and 2002, on a pre-tax basis, expense (income) of

$27 million, $(1) million and $(10) million, respectively, was reclassiÑed from equity to earnings and is included in

Other within Other Income (Expense) in the Company's consolidated statements of operations. If exchange rates

do not change from year-end, the Company estimates that $90 million of pre-tax net derivative losses included in

Non-Owner Changes to Equity within Stockholders' Equity would be reclassiÑed into earnings within the next

twelve months and will be reclassiÑed in the same period that the hedged item aÅects earnings. The actual amounts

that will be reclassiÑed into earnings over the next twelve months will vary from this amount as a result of changes

in market conditions.

At December 31, 2004, the maximum term of derivative instruments that hedge forecasted transactions was

four years. However, on average, the duration of the Company's derivative instruments that hedge forecasted

transactions was Ñve months.

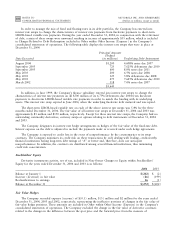

Net Investment in Foreign Operations Hedge

At December 31, 2004 and 2003, the Company did not have any hedges of foreign currency exposure of net

investments in foreign operations. However, the Company expects that it may hedge investments in foreign

subsidiaries in the future.

Investments Hedge

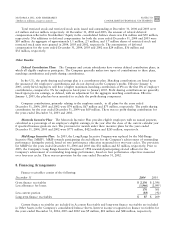

In March 2003, the Company entered into three agreements with multiple investment banks to hedge up to

25 million of its shares of common stock of Nextel Communications, Inc. (""Nextel''). The three agreements are to

be settled over periods of three, four and Ñve years, respectively. Under these agreements, the Company received no

initial proceeds, but has retained the right to receive, at any time during the contract periods, the present value of

the aggregate contract ""Öoor'' price. Pursuant to these agreements, and exclusive of any present value discount, the

Company is entitled to receive aggregate proceeds of approximately $333 million. The precise number of shares of

Nextel common stock that the Company will deliver to satisfy the contracts is dependent upon the price of Nextel

common stock on the various settlement dates. The maximum aggregate number of shares the Company would be

required to deliver under these agreements is 25 million and the minimum number of shares is 18.5 million.

Alternatively, the Company has the exclusive option to settle the contracts in cash. The Company will retain all

voting rights associated with the up to 25 million hedged Nextel shares. Pursuant to customary market practice, the

covered shares are pledged to secure the hedge contracts. The Company has recorded $340 million and

$310 million as of December 31, 2004 and 2003, respectively, in Other Liabilities in the consolidated balance sheet

to reÖect the fair value of the Nextel hedge.

Fair Value of Financial Instruments

The Company's Ñnancial instruments include cash equivalents, short-term investments, accounts receivable,

long-term Ñnance receivables, accounts payable, accrued liabilities, notes payable, long-term debt, foreign currency

contracts and other Ñnancing commitments.

Using available market information, the Company determined that the fair value of long-term debt at

December 31, 2004 was $5.4 billion compared to a carrying value of $5.0 billion. Since considerable judgment is