Motorola 2004 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Commercial, Government and Industrial Solutions Segment

The Commercial, Government and Industrial Solutions segment (""CGISS'') designs, manufactures, sells, installs

and services analog and digital two-way radio, voice and data communications products and systems to a wide

range of public-safety, government, utility, courier, transportation and other worldwide markets. The business

continues to invest in the market for broadband data, including infrastructure, devices, service and applications. In

addition, the segment participates in the expanding market for integrated information management, mobile and

biometric applications and services. In 2004, CGISS's net sales represented 15% of the Company's consolidated net

sales, compared to 18% in 2003 and 16% in 2002.

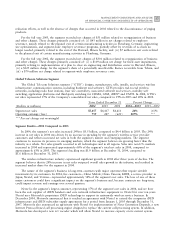

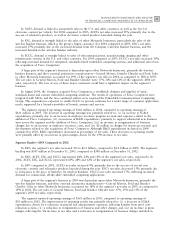

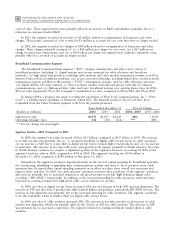

Years Ended December 31 Percent Change

(Dollars in millions)

2004

2003 2002

2004Ì2003

2003Ì2002

Segment net sales $4,588 $4,131 $3,749 11% 10%

Operating earnings 753 562 313 34% 80%

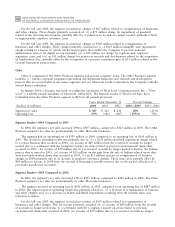

Segment ResultsÌ2004 Compared to 2003

In 2004, the segment's net sales increased 11% to $4.6 billion, compared to $4.1 billion in 2003. The increase

in net sales reÖects continued emphasis on spending by customers in the segment's government market, primarily in

response to homeland security initiatives, as well as increased spending by the segment's enterprise customers on

business-critical communications needs. The overall increase in net sales reÖects net sales growth in all regions. Net

sales in North America continue to comprise a signiÑcant portion of the segment's business, accounting for 66% of

the segment's net sales in both 2004 and 2003. The segment's backlog was $2.1 billion at December 31, 2004,

compared to $1.7 billion at December 31, 2003. The increase in backlog was driven by the awarding of large,

multi-year projects in the segment's government market during the latter half of 2004.

The segment's operating earnings increased to $753 million in 2004, compared to operating earnings of

$562 million in 2003. The 34% increase in operating earnings was primarily due to: (i) the 11% increase in net

sales, (ii) cost savings from supply-chain eÇciencies, and (iii) overall cost structure improvements. Also

contributing to the increase in operating earnings was a decrease in reorganization of business charges, primarily due

to a decrease in charges related to segment-wide employee severance. These improvements in operating results were

partially oÅset by: (i) an increase in SG&A expenditures, primarily due to an increase in employee incentive

program accruals and an increase in selling and sales support expenditures, due primarily to the 11% increase in net

sales, (ii) an increase in R&D expenditures driven by increased investment in new technologies, and

(iii) $17 million of in-process research and development charges related to the acquisitions of MeshNetworks, Inc.

(""MeshNetworks'') and CRISNET, Inc. (""CRISNET'')

In the fourth quarter of 2004, the Company completed the acquisitions of MeshNetworks and CRISNET.

MeshNetworks is a leading developer of mobile mesh networking and position-location technologies. The

technologies make it possible to deploy high-performance Internet Protocol-based wireless networks. The

acquisition supports Motorola's seamless mobility vision and will strengthen the solution portfolio for wireless

broadband customers. CRISNET has a suite of advanced software applications for law enforcement, justice and

public safety agencies. This group of products will enable Motorola to build upon its customer and technology

leadership in the public safety market.

Spending by the segment's government and public safety customers is aÅected by government budgets at the

national, state and local levels. In the U.S., where the majority of the segments sales occur, the 2005 Department of

Homeland Security Appropriations Act was passed in October 2004, providing for an increase over 2004's

discretionary spending budget. However, it is very diÇcult to tell how much of that funding will be used for

communications needs. Also, recent U.S. federal government budget proposals have indicated potential funding

reductions to state and local agencies that purchase our products and systems. In addition, even in light of limited

budgets for local governments and public safety agencies, the segment sees increased prioritization of limited

government funds towards funding of safety and security projects. Particularly, customers in the government market

are interested in two-way radio systems and integrated solutions that enhance interoperability and compatibility.

Accordingly, the segment does not expect reductions in U.S. federal government funding to state and local agencies

to have a material impact on its business in 2005. The segment will continue to work closely with all pertinent

government departments and agencies to ensure that two-way radio and wireless communications is positioned as a

critical need for homeland security.