Motorola 2004 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

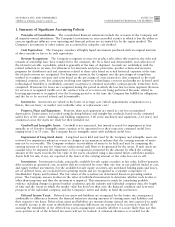

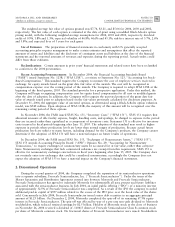

MOTOROLA INC. AND SUBSIDIARIES NOTES TO

CONSOLIDATED FINANCIAL STATEMENTS(Dollars in millions, except as noted)

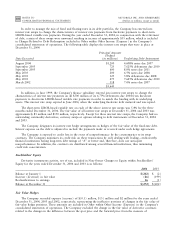

Property, Plant, and Equipment

Property, Plant and Equipment, net, consists of the following:

December 31

2004

2003

Land $ 200 $ 212

Building 1,959 2,061

Machinery and equipment 6,222 6,189

8,381 8,462

Less accumulated depreciation (6,049) (5,989)

Property, plant and equipment, net $ 2,332 $ 2,473

Depreciation expense for the years ended December 31, 2004, 2003 and 2002 was $561 million, $663 million

and $903 million, respectively.

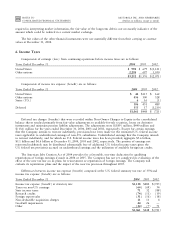

Investments

Investments consist of the following:

December 31

2004

2003

Available-for-sale securities:

Cost basis $ 616 $ 499

Gross unrealized gains 2,296 2,438

Gross unrealized losses (7) (8)

Fair value 2,905 2,929

Other securities, at cost 213 226

Equity method investments 123 147

$3,241 $3,302

The Company recorded investment impairment charges of $36 million, $96 million and $1.2 billion for the

years ended December 31, 2004, 2003 and 2002, respectively. These impairment charges represent other-than-

temporary declines in the value of the Company's investment portfolio. The $96 million of impairment charges in

2003 is primarily comprised of a $29 million charge to write down to zero the Company's debt security holdings in

a European cable operator and other cost-based investment write-downs. The $1.2 billion of impairment charges in

2002, is primarily comprised of: (i) a $464 million writedown in the value of the Company's investment in Nextel

Communications, Inc.; (ii) a $73 million writedown of the Company's investment in Telus Corporation; (iii) a

$321 million writedown of the Company's debt security holdings and associated warrants in Callahan Associates

International L.L.C.; and (iv) a $95 million charge to write the value of the Company's investment in an Argentine

cellular operating company to zero. Investment impairment charges are included in Other within Other Income

(Expense) in the Company's consolidated statements of operations.

Gains on sales of investments and businesses, consists of the following:

Years Ended December 31

2004

2003 2002

Gains on sales of investments $434 $524 $27

Gains on sales of businesses 26 15 54

$460 $539 $81

For the year ended December 31, 2004, the $460 million gain on sales of investments and businesses is

primarily comprised of: (i) a $130 million gain on the sale of the Company's remaining shares in Broadcom

Corporation, (ii) a $122 million gain on the sale of a portion of the Company's shares in Nextel Communications,

Inc., (iii) an $82 million gain on the sale of a portion of the Company's shares in Telus Corporation, and (iv) a

$68 million gain on the sale of a portion of the Company's shares in Nextel Partners, Inc.

For the year ended December 31, 2003, the $539 million gain on sales of investments and businesses is

primarily comprised of: (i) a $255 million gain on the sale of a portion of common stock in Nextel

Communications, Inc., (ii) an $80 million gain on the sale of the Company's shares in Symbian Limited, (iii) a