Motorola 2004 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The Company executes contracts with customers that describe the equipment and system speciÑcations to be

delivered, including the consideration to be received. Revenue is recognized as work progresses on each contract

and is based on the percentage of costs incurred to date compared to the total estimated contract costs. Estimates

of total contract costs and progress toward completion of each contract are prepared using estimates and judgments

based on historical experience and on other factors believed to be relevant under the circumstances. Management

regularly assesses normal, recurring business risks and uncertainties inherent in these customer contracts and

considers the impact, if any, of these uncertainties in the preparation of contract estimates. These uncertainties may

include system performance and implementation delays resulting from events both within and outside the control of

the Company. Losses on individual contracts, if any, are recognized during the period in which the loss Ñrst

becomes evident.

Changes in these estimates could negatively impact the Company's operating results. In addition, unforeseen

conditions could arise over the contract term that may have a signiÑcant impact on the operating results. It is

reasonably likely that diÅerent operating results would be reported if the Company used other acceptable revenue

recognition methodologies, such as the completed-contract method, or applied diÅerent assumptions.

Deferred Tax Asset Valuation

The Company recognizes deferred tax assets and liabilities based on the diÅerences between the Ñnancial

statement carrying amounts and the tax bases of assets and liabilities. The Company regularly reviews its deferred

tax assets for recoverability and establishes a valuation allowance based on historical taxable income, projected

future taxable income, the expected timing of the reversals of existing temporary diÅerences and the

implementation of tax-planning strategies. If the Company is unable to generate suÇcient future taxable income in

certain tax jurisdictions, or if there is a material change in the actual eÅective tax rates or time period within which

the underlying temporary diÅerences become taxable or deductible, the Company could be required to increase its

valuation allowance against its deferred tax assets resulting in an increase in its eÅective tax rate and an adverse

impact on operating results.

At December 31, 2004 and 2003, the Company's deferred tax assets related to U.S. tax carryforwards were

$1.5 billion and $1.2 billion, respectively. The tax carryforwards are comprised of net operating loss carryforwards,

foreign tax credit and other tax credit carryovers. A majority of the net operating losses and other tax credits can

be carried forward for 20 years. The carryforward period for foreign tax credits was extended to ten years, from

Ñve years, during 2004 due to the enactment of the American Jobs Creation Act of 2004.

The Company has recorded valuation allowances for certain state deferred tax assets, state tax loss

carryforwards with carryforward periods of seven years or less, tax loss carryforwards of acquired entities that are

subject to limitations and tax loss carryforwards of certain non-U.S. subsidiaries. The Company believes that the

deferred tax assets for the remaining tax carryforwards are considered more likely than not to be realizable based

on estimates of future taxable income and the implementation of tax planning strategies.

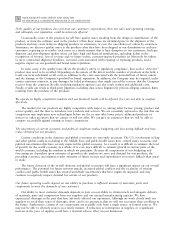

Inventory Valuation Reserves

The Company records valuation reserves on its inventory for estimated obsolescence or unmarketability. The

amount of the reserve is equal to the diÅerence between the cost of the inventory and the estimated market value

based upon assumptions about future demand and market conditions. On a quarterly basis, management in each

segment performs an analysis of the underlying inventory to identify reserves needed for excess and obsolescence

and for the remaining inventory assesses the net realizable value. Management uses its best judgment to estimate

appropriate reserves based on this analysis.

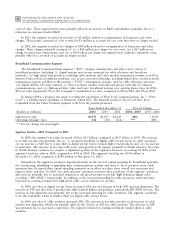

Net Inventories consisted of the following:

December 31

2004

2003

Finished goods $1,429 $ 830

Work-in-process and production materials 1,665 1,861

3,094 2,691

Less inventory reserves (548) (592)

$2,546 $2,099