Motorola 2004 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

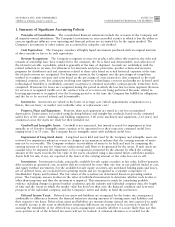

92 MOTOROLA INC. AND SUBSIDIARIESNOTES TO

CONSOLIDATED FINANCIAL STATEMENTS (Dollars in millions, except as noted)

entitled to fractional shares of Freescale Semiconductor Class B common stock in the distribution received the cash

value instead. The equity distribution was structured to be tax-free to Motorola stockholders for U.S. tax purposes

(other than with respect to any cash received in lieu of fractional shares). The historical results of Freescale

Semiconductor have been reÖected as discontinued operations in the underlying Ñnancial statements and related

disclosures for all periods presented. As a result, the historical footnote disclosures have been revised to exclude

amounts related to Freescale Semiconductor.

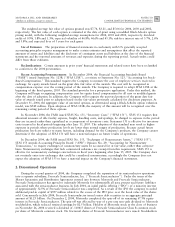

The following table displays summarized Ñnancial information for discontinued operations:

Years Ended December 31

2004*

2003 2002

Net sales (including sales to other Motorola businesses of $1,154 million, $961 million

and $1,143 million for the years ended December 31, 2004, 2003 and 2002,

respectively.) $5,180 $4,864 $ 5,000

Operating earnings (loss) 213 (189) (1,370)

Earnings (loss) before income taxes 241 (83) (1,375)

Income tax expense (beneÑt) 900 (48) (240)

Loss from discontinued operations, net of tax (659) (35) (1,135)

* Includes the results of operations through December 2, 2004

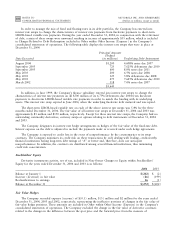

The following table displays a summary of the assets and liabilities of discontinued operations as of

December 31, 2003.

December 31, 2003

Assets

Cash and cash equivalents $87

Accounts receivable, net 284

Inventories, net 693

Deferred income taxes, current 314

Other current assets 309

Property, plant and equipment, net 2,691

Deferred income taxes, non-current 576

Other assets 290

$5,244

Liabilities

Notes payable and current portion of long-term debt $ 27

Accounts payable 331

Accrued liabilities 382

Long-term debt 2

Other liabilities 233

$ 975