Motorola 2004 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90 MOTOROLA INC. AND SUBSIDIARIESNOTES TO

CONSOLIDATED FINANCIAL STATEMENTS (Dollars in millions, except as noted)

portion of the deferred tax assets that are not expected to be realized based on the level of historical taxable

income, projections for future taxable income over the periods in which the temporary diÅerences are deductible

and allowable tax planning strategies.

Finance Receivables: Finance receivables include trade receivables where contractual terms of the note

agreement are greater than one year. Finance receivables are considered impaired when management determines it is

probable that the Company will be unable to collect all amounts due according to the contractual terms of the

note agreement, including principal and interest. Impaired Ñnance receivables are valued based on the present value

of expected future cash Öows, discounted at the receivable's eÅective rate of interest, or the fair value of the

collateral if the receivable is collateral dependent. Interest income and late fees on impaired Ñnance receivables are

recognized only when payments are received. Previously impaired Ñnance receivables are no longer considered

impaired and are reclassiÑed to performing when they have performed under a work out or restructuring for four

consecutive quarters.

Fair Values of Financial Instruments: The fair values of Ñnancial instruments are determined based on quoted

market prices and market interest rates as of the end of the reporting period. The Company's Ñnancial instruments

include cash and cash equivalents, short-term investments, accounts receivable, long-term Ñnance receivables,

accounts payable, accrued liabilities, notes payable, long-term debt, foreign currency contracts and other Ñnancing

commitments. The fair values of these Ñnancial instruments were, with the exception of long-term debt as disclosed

in Note 5, not materially diÅerent from their carrying or contract values at December 31, 2004 and 2003.

Foreign Currency Translation: Many of the Company's non-U.S. operations use the respective local

currencies as the functional currency. Those non-U.S. operations which do not use the local currency as the

functional currency use the U.S. dollar. The eÅects of translating the Ñnancial position and results of operations of

local currency functional operations into U.S. dollars are included in a separate component of Stockholders' Equity.

Foreign Currency Transactions: The eÅects of remeasuring the non-functional currency assets or liabilities

into the functional currency, as well as gains and losses on hedges of existing assets, or liabilities are marked-to-

market and the result is included within Other Income (Expense) in the consolidated statements of operations.

Gains and losses on Ñnancial instruments that hedge Ñrm future commitments are deferred until such time as the

underlying transactions are recognized or recorded immediately when the transaction is no longer expected to

occur. Gains or losses on Ñnancial instruments that do not qualify as hedges under Statement of Financial

Accounting Standards (""SFAS'') No. 133, ""Accounting for Derivative Instruments and Hedging Activities,'' are

recognized immediately as income or expense.

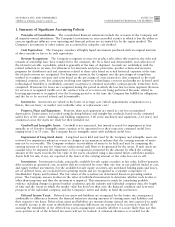

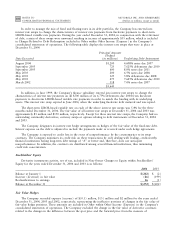

Stock Compensation Costs: The Company measures compensation cost for stock options and restricted stock

using the intrinsic value-based method. Compensation cost, if any, is recorded based on the excess of the quoted

market price at grant date over the amount an employee must pay to acquire the stock. The Company has

evaluated the pro forma eÅects of using the fair value-based method of accounting and has presented below the pro

forma eÅects on both earnings (loss) from continuing operations and on net earnings (loss), which includes

discontinued operations.

Continuing Operations Net Earnings

Years Ended December 31

2004

2003 2002

2004

2003 2002

Earnings (loss):

Earnings (loss), as reported $2,191 $ 928 $(1,350) $1,532 $ 893 $(2,485)

Add: Stock-based employee compensation expense

included in reported earnings (loss), net of related tax

eÅects 15 23 22 19 27 28

Deduct: Stock-based employee compensation expense

determined under fair value-based method for all

awards, net of related tax eÅects (150) (187) (257) (188) (249) (319)

Pro forma earnings (loss) $2,056 $ 764 $(1,585) $1,363 $ 671 $(2,776)

Basic earnings (loss) per common share:

As reported $ 0.93 $ 0.40 $ (0.59) $ 0.65 $ 0.38 $ (1.09)

Pro forma $ 0.87 $ 0.33 $ (0.69) $ 0.58 $ 0.29 $ (1.22)

Diluted earnings (loss) per common share:

As reported $ 0.90 $ 0.39 $ (0.59) $ 0.64 $ 0.38 $ (1.09)

Pro forma $ 0.85 $ 0.33 $ (0.69) $ 0.57 $ 0.29 $ (1.22)