Motorola 2004 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

MOTOROLA INC. AND SUBSIDIARIES NOTES TO

CONSOLIDATED FINANCIAL STATEMENTS(Dollars in millions, except as noted)

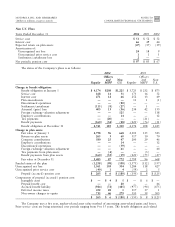

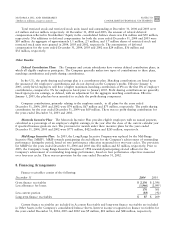

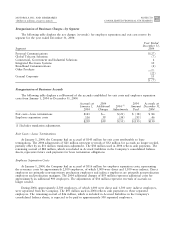

expense, net of sublease income for the years ended December 31, 2004, 2003 and 2002 was $217 million,

$223 million and $218 million, respectively. At December 31, 2004, future minimum lease obligations, net of

minimum sublease rentals, for the next Ñve years and beyond are as follows: 2005Ì$211 million;

2006Ì$158 million; 2007Ì$115 million; 2008Ì$89 million; 2009Ì$69 million; beyondÌ$194 million.

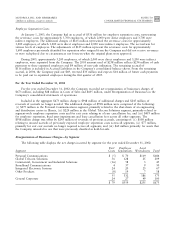

Legal

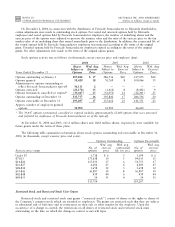

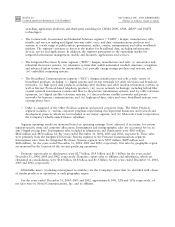

Iridium Program: Motorola has been named as one of several defendants in putative class action securities

lawsuits arising out of alleged misrepresentations or omissions regarding the Iridium satellite communications

business, which on March 15, 2001, were consolidated in the District of Columbia under Freeland v. Iridium

World Communications, Inc., et al., originally Ñled on April 22, 1999. On August 31, 2004, the court denied the

motions to dismiss that had been Ñled on July 15, 2002 by Motorola and the other defendants.

Motorola has been sued by the OÇcial Committee of the Unsecured Creditors of Iridium in the Bankruptcy

Court for the Southern District of New York on July 19, 2001. In re Iridium Operating LLC, et al. v. Motorola

asserts claims for breach of contract, warranty, Ñduciary duty, and fraudulent transfer and preferences, and seeks in

excess of $4 billion in damages.

The Company has not reserved for any potential liability that may arise as a result of litigation related to the

Iridium program. While the still pending cases are in various stages and the outcomes are not predictable, an

unfavorable outcome of one or more of these cases could have a material adverse eÅect on the Company's

consolidated Ñnancial position, liquidity or results of operations.

Other: The Company is a defendant in various other suits, claims and investigations that arise in the normal

course of business. In the opinion of management, and other than discussed above with respect to the Iridium

cases, the ultimate disposition of these matters will not have a material adverse eÅect on the Company's

consolidated Ñnancial position, liquidity or results of operations.

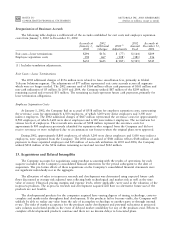

Other

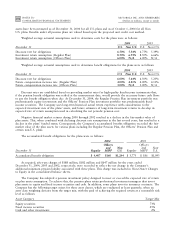

The Company is also a party to a variety of agreements pursuant to which it is obligated to indemnify the

other party with respect to certain matters. Some of these obligations arise as a result of divestitures of the

Company's assets or businesses and require the Company to hold the other party harmless against losses arising

from adverse tax outcomes. The total amount of indemniÑcation under these types of provisions at December 31,

2004 and 2003 was $37 million and $100 million, respectively, with the Company accruing $2 million and

$42 million as of December 31, 2004 and 2003, respectively, for certain claims that have been asserted under these

provisions.

In addition, the Company may provide indemniÑcations for losses that result from the breach of general

warranties contained in certain commercial, intellectual property and divestiture agreements. Historically the

Company has not made signiÑcant payments under these agreements, nor have there been signiÑcant claims asserted

against the Company as of December 31, 2004.

In all cases, payment by the Company is conditioned on the other party making a claim pursuant to the

procedures speciÑed in the particular contract, which procedures typically allow the Company to challenge the

other party's claims. Further, the Company's obligations under these agreements are generally limited in terms of

duration, typically not more than 24 months, and or amounts not in excess of the contract value, and in some

instances, the Company may have recourse against third parties for certain payments made by the Company.

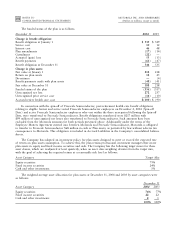

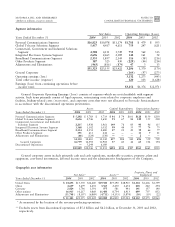

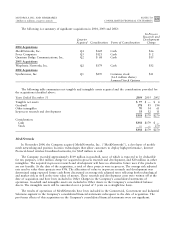

10. Information by Segment and Geographic Region

The Company's reportable segments have been determined based on the nature of the products oÅered to

customers and are comprised of the following:

‚ The Personal Communications segment (""PCS'') designs, manufactures, sells and services wireless handsets

with integrated software and accessory products.

‚ The Global Telecom Solutions segment (""GTSS'') designs, manufactures, sells, installs, and services wireless

infrastructure communication systems, including hardware and software. GTSS provides end-to-end wireless

networks, including radio base stations, base site controllers, associated software and services, mobility soft