Motorola 2004 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116 MOTOROLA INC. AND SUBSIDIARIESNOTES TO

CONSOLIDATED FINANCIAL STATEMENTS (Dollars in millions, except as noted)

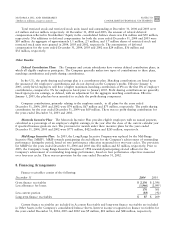

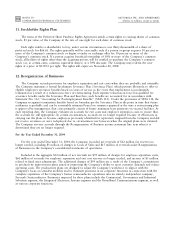

11. Stockholder Rights Plan

The terms of the Preferred Share Purchase Rights Agreement attach certain rights to existing shares of common

stock, $3 par value, of the Company at the rate of one right for each share of common stock.

Each right entitles a shareholder to buy, under certain circumstances, one thirty-thousandth of a share of

preferred stock for $66.66. The rights generally will be exercisable only if a person or group acquires 10 percent or

more of the Company's common stock or begins a tender or exchange oÅer for 10 percent or more of the

Company's common stock. If a person acquires beneÑcial ownership of 10% or more of the Company's common

stock, all holders of rights other than the acquiring person, will be entitled to purchase the Company's common

stock (or, in certain cases, common equivalent shares) at a 50% discount. The Company may redeem the new

rights at a price of $0.0033 per right. The rights will expire on November 20, 2008.

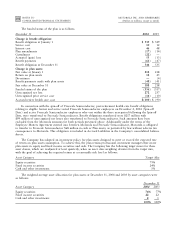

12. Reorganization of Businesses

The Company records provisions for employee separation and exit costs when they are probable and estimable.

The Company maintains a formal Involuntary Severance Plan (Severance Plan) which permits Motorola to oÅer to

eligible employees severance beneÑts based on years of service in the event that employment is involuntarily

terminated as a result of a reduction-in-force or restructuring. Each separate reduction-in-force has qualiÑed for

severance beneÑts under the Severance Plan and therefore, such beneÑts are accounted for in accordance with

Statement No. 112, ""Accounting for Postemployment BeneÑts'' (SFAS 112). Under the provisions of SFAS 112, the

Company recognizes termination beneÑts based on formulas per the Severance Plan at the point in time that future

settlement is probable and can be reasonably estimated based on estimates prepared at the time a restructuring plan

is approved by management. Exit costs primarily consist of future minimum lease payments on vacated facilities. At

each reporting date, the Company evaluates its accruals for exit costs and employee separation costs to ensure that

the accruals are still appropriate. In certain circumstances, accruals are no longer required because of eÇciencies in

carrying out the plans or because employees previously identiÑed for separation resigned from the Company and did

not receive severance or were redeployed due to circumstances not foreseen when the original plans were initiated.

The Company reverses accruals through the Reorganization of Business income statement line item when it is

determined they are no longer required.

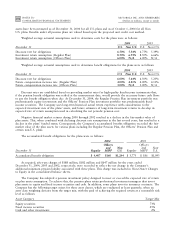

For the Year Ended December 31, 2004

For the year ended December 31, 2004, the Company recorded net reversals of $12 million for reserves no

longer needed, including $3 million of charges in Costs of Sales and $15 million of reversals under Reorganization

of Businesses in the Company's consolidated statements of operations.

Included in the aggregate $12 million of net reversals are $59 million of charges for employee separation costs,

$66 million of reversals for employee separation and exit cost reserves no longer needed, and income of $5 million

related to Ñxed asset adjustments. The additional charges of $59 million are a result of the Company's commitment

to productivity improvement plans aimed at improving the Company's ability to meet customer demands and reduce

operating costs. The productivity plans are designed to adjust the Company's workforce to align it with the

Company's focus on seamless mobility and to eliminate positions in its corporate functions in connection with the

complete separation of the Company's former semiconductor operations into an entirely independent company,

Freescale Semiconductor. Businesses impacted by these plans include the Commercial, Government and Industrial

Solutions segment, the Integrated Electronic Systems segment and the Broadband Communications segment, as well

as various corporate functions.