Motorola 2004 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

reduction eÅorts, as well as the absence of charges that occurred in 2002 related to the discontinuance of paging

products.

For the full year 2003, the segment recorded net charges of $51 million related to reorganization of business

and other charges. These charges primarily consisted of: (i) $43 million in net charges related to employee

severance, mainly related to the planned exit of certain manufacturing activities in Flensburg, Germany, engineering

site optimizations, and segment-wide employee severance programs, partially oÅset by reversals of accruals no

longer needed, primarily related to the exit of the Harvard, Illinois facility, and (ii) $7 million in exit costs related

to the planned exit of certain manufacturing activities in Flensburg, Germany.

For the full year 2002, the segment recorded net charges of $301 million related to reorganization of business

and other charges. These charges primarily consisted of: (i) a $119 million net charge for Ñxed asset impairments,

primarily relating to implementation of a plan to close an engineering and distribution center in Harvard, Illinois,

(ii) a $125 million charge for the segment's share of a potentially uncollectible Ñnance receivable from Telsim, and

(iii) a $70 million net charge related to segment-wide employee severance costs.

Global Telecom Solutions Segment

The Global Telecom Solutions segment (""GTSS'') designs, manufactures, sells, installs, and services wireless

infrastructure communication systems, including hardware and software. GTSS provides end-to-end wireless

networks, including radio base stations, base site controllers, associated software and services, mobility soft

switching, application platforms and third-party switching for CDMA, GSM, iDEN» and UMTS. In 2004, GTSS's

net sales represented 17% of the Company's consolidated net sales, compared to 19% in 2003 and 20% in 2002.

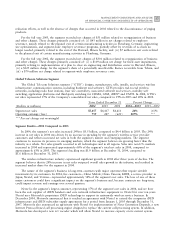

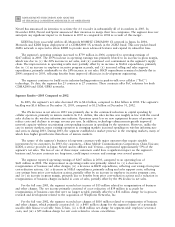

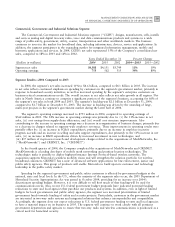

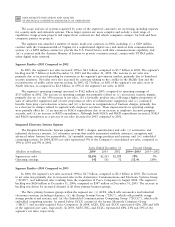

Years Ended December 31 Percent Change

(Dollars in millions)

2004

2003 2002

2004Ì2003

2003Ì2002

Segment net sales $5,457 $4,417 $4,611 24% (4)%

Operating earnings (loss) 759 247 (621) 207% ***

*** Percent change not meaningful

Segment ResultsÌ2004 Compared to 2003

In 2004, the segment's net sales increased 24% to $5.5 billion, compared to $4.4 billion in 2003. The 24%

increase in net sales in 2004 was driven by an increase in spending by the segment's wireless service provider

customers and reÖects increased net sales in both the segment's mature and emerging markets. The segment

continues to increase its presence in emerging markets, which the segment believes are growing faster than the

industry as a whole. Net sales growth occurred in all technologies and in all regions. Sales into non-U.S. markets

increased in 2004 and represented approximately 66% of the segment's total net sales in 2004, compared to

approximately 63% in 2003. The segment's backlog was $1.9 billion at December 31, 2004, compared to

$1.6 billion at December 31, 2003.

The wireless infrastructure industry experienced signiÑcant growth in 2004 after three years of decline. The

segment believes that its 24% increase in net sales outpaced overall sales growth in the industry, and resulted in

increased market share for the segment in 2004.

The nature of the segment's business is long-term contracts with major operators that require sizeable

investments by its customers. In 2004, Ñve customersÌChina Mobile; China Unicom; KDDI, a service provider in

Japan; Nextel; and VerizonÌrepresented approximately 54% of the segment's net sales. The loss of one of these

major customers could have a signiÑcant impact on the segment's business and, because contracts are long-term,

could impact revenue and earnings over several quarters.

Nextel is the segment's largest customer, representing 17% of the segment's net sales in 2004, and we have

been the sole supplier of iDEN handsets and core network infrastructure equipment to Nextel for over ten years.

Nextel uses Motorola's proprietary iDEN technology to support its nationwide wireless service business. In

December 2004, Motorola announced that it reached an agreement with Nextel to extend the companies iDEN

infrastructure and iDEN subscriber supply agreements for a period from January 1, 2005 through December 31,

2007. Motorola also announced an agreement with Nextel for implementation of Next Generation Dispatch, a new

Internet Protocol-based call processing engine designed to replace the current call-processing system. In addition,

Motorola has developed a new 6:1 vocoder which will allow Nextel to increase capacity on its current system.