Motorola 2004 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122 MOTOROLA INC. AND SUBSIDIARIESNOTES TO

CONSOLIDATED FINANCIAL STATEMENTS (Dollars in millions, except as noted)

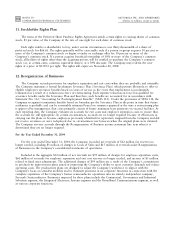

Force Computers

In August 2004, the Company acquired Force Computers, (""Force''), a worldwide designer and supplier of

open, standards-based and custom embedded computing solutions, for $121 million in cash.

The Company recorded approximately $59 million in goodwill, none of which is expected to be deductible for

tax purposes, a $2 million charge for acquired in-process research and development, and $35 million in other

intangibles. The in-process research and development costs were written oÅ at the date of acquisition and have

been included in Other Charges in the Company's consolidated statements of operations. Goodwill and intangible

assets are included in Other Assets in the Company's consolidated balance sheets. The intangible assets will be

amortized over a period of 5 years on a straight-line basis.

The results of operations of Force have been included in the Integrated Electronic Systems segment in the

Company's consolidated Ñnancial statements subsequent to the date of acquisition. The pro forma eÅects of this

acquisition on the Company's consolidated Ñnancial statements were not signiÑcant.

Quantum Bridge

In May 2004, the Company acquired Quantum Bridge Communications, Inc. (""Quantum Bridge''), a leading

provider of Ñber-to-the-premises solutions, for $55 million in cash. Terms of the acquisition include contingent

purchase price payments, to be made by Motorola to the sellers, not to exceed $143 million. The payments are

contingent upon certain milestones being met, primarily related to future revenue targets extending through 2007. In

October 2004, the Company paid an additional $13 million as a result of certain of the milestones being met. This

payment, along with any future contingent payments, will be included as part of the purchase price if and when the

milestones are met.

The Company recorded a $15 million charge for acquired in-process research and development costs and

$15 million in other intangible assets. The acquired in-process research and development will have no alternative

future uses if the products are not feasible. The allocation of value to in-process research and development was

determined using expected future cash Öows discounted at average risk adjusted rates reÖecting both technological

and market risk as well as the time value of money. These research and development costs were written oÅ at the

date of acquisition and have been included in Other Charges in the Company's consolidated statements of

operations. Goodwill and other intangible assets are included in Other Assets in the Company's consolidated

balance sheets. The intangible assets will be amortized over periods ranging from 4 to 14 years on a straight-line

basis.

The results of operations of Quantum Bridge have been included in the Broadband Communications segment

in the Company's consolidated Ñnancial statements subsequent to the date of acquisition. The pro forma eÅects of

this acquisition on the Company's Ñnancial statements were not signiÑcant.

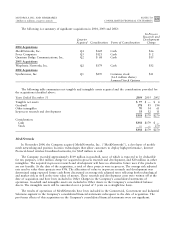

Winphoria Networks

In May 2003, the Company acquired Winphoria Networks, Inc. (""Winphoria''), a core infrastructure provider

of next-generation, packet-based mobile switching centers for wireless networks, for approximately $179 million in

cash.

The Company recorded approximately $93 million in goodwill, none of which is expected to be deductible for

tax purposes, a $32 million charge for acquired in-process research and development, and $54 million in other

intangibles. The acquired in-process research and development will have no alternative future uses if the products

are not feasible. At the date of the acquisition, a total of eight projects were in process. The average risk adjusted

rate used to value these projects ranged from 25% to 28%. The allocation of value to in-process research and

development was determined using expected future cash Öows discounted at average risk adjusted rates reÖecting

both technological and market risk as well as the time value of money. These research and development costs were

written oÅ at the date of acquisition and have been included in Other Charges in the Company's consolidated

statements of operations. Goodwill and intangible assets are included in Other Assets in the Company's

consolidated balance sheets. The intangible assets will be amortized over periods ranging from 3 to 5 years on a

straight-line basis.