Motorola 2004 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

costs of sales. These improvements were partially oÅset by an increase in R&D expenditures, primarily due to a

reduction in customer-funded R&D.

In 2003, the segment recorded net income of $1 million related to reorganization of businesses and other

charges. This income consisted of a net reversal of $1 million in accruals for exit costs that were no longer needed.

In 2002, the segment recorded net charges of $58 million related to reorganization of businesses and other

charges. These charges primarily consisted of: (i) a $24 million net charge for exit costs, (ii) a $23 million net

charge for Ñxed asset impairments, and (iii) a $20 million net charge for segment-wide employee separation costs,

partially oÅset by a reversal of accruals no longer needed.

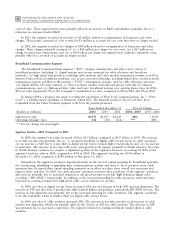

Broadband Communications Segment

The Broadband Communications segment (""BCS'') designs, manufactures and sells a wide variety of

broadband products, including: (i) digital systems and set-top terminals for cable television and broadcast

networks, (ii) high speed data products, including cable modems and cable modem termination systems, as well as

Internet Protocol-based telephony products, (iii) access network technology, including hybrid Ñber coaxial network

transmission systems and Ñber-to-the-premise (""FTTP'') transmission systems, used by cable television operators,

(iv) digital satellite television systems, (v) direct-to-home satellite networks and private networks for business

communications, and (vi) high-speed data, video and voice broadband systems over existing phone lines. In 2004,

BCS net sales represented 7% of the Company's consolidated net sales, compared to 8% in 2003 and 9% in 2002.

In January 2004, a decision was made to realign the operations of Next Level Communications, Inc. (""Next

Level''), a wholly-owned subsidiary of Motorola, within BCS. The Ñnancial results of Next Level have been

reclassiÑed from the Other Products segment to BCS for all periods presented.

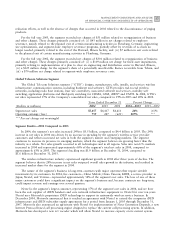

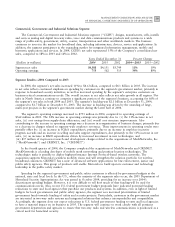

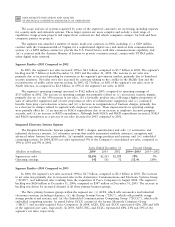

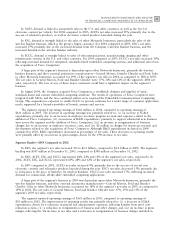

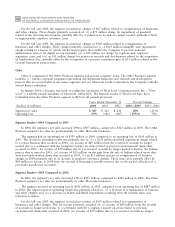

Years Ended December 31 Percent Change

(Dollars in millions)

2004

2003 2002

2004Ì2003

2003Ì2002

Segment net sales $2,335 $1,857 $2,143 26% (13)%

Operating earnings (loss) 116 (38) (216) *** 82%

*** Percent change not meaningful

Segment ResultsÌ2004 Compared to 2003

In 2004, the segment's net sales increased 26% to $2.3 billion, compared to $1.9 billion in 2003. The increase

in overall net sales was primarily due to: (i) increased purchases of digital cable set-top boxes by cable operators,

(ii) an increase in ASP due to a mix shift in digital set-top boxes towards higher-end products, and (iii) an increase

in retail sales. The increase in net sales reÖects net sales growth in all regions, primarily in North America. Net sales

in North America continue to comprise a signiÑcant portion of the segment's business, accounting for 83% of the

segment's total net sales in 2004, compared to 85% in 2003. The segment's backlog was $314 million at

December 31, 2004, compared to $299 million at December 31, 2003.

Demand for the segment's products depends primarily on the level of capital spending by broadband operators

for constructing, rebuilding or upgrading their communications systems and services. In recent prior years, cable

operators have decreased their capital spending, primarily in an eÅort to reduce their overall cost structures and

improve their cash Öow. In 2004, our cable operator customers increased their purchases of the segment's products

and services, primarily due to increased demand for advanced set-tops to provide high-deÑnition/digital video

recording (""HD/DVR'') functionality. In addition to the increased spending by cable operators, retail sales have

increased as consumer demand for high-speed cable access continues to increase.

In 2004, net sales of digital set-top boxes increased 29%, due to increases in both ASP and unit shipments. The

increase in ASP was driven by a product-mix shift towards higher-end products, particularly HD/DVR set-tops. The

increase in unit shipments was primarily due to the increased spending by cable operators. The segment continued

to be the worldwide leader in market share for digital cable set-top boxes.

In 2004, net sales of cable modems increased 20%. The increase in net sales was due to an increase in cable

modem unit shipments, which was partially oÅset by the decline in ASP for cable modems. The decrease in ASP

was primarily due to increased competition. The segment retained its leading worldwide market share in cable

modems.