Motorola 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

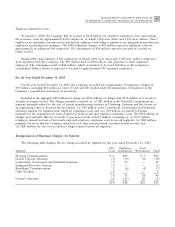

Reorganization of Businesses Accruals

The following table displays a rollforward of the accruals established for exit costs and employee separation

costs from January 1, 2003 to December 31, 2003:

Accruals at 2003 Accruals at

January 1, Additional 2003(1) 2003 Amount December 31,

2003 Charges Adjustments Used 2003

Exit costs Ì lease terminations $209 $ 11 $ (20) $ (57) $143

Employee separation costs 336 163 (125) (258) 116

$545 $174 $(145) $(315) $259

(1) Includes translation adjustments.

Exit Costs Ì Lease Terminations

The 2003 additional charges of $11 million were primarily related to the exit of certain manufacturing activities

in Germany by the Personal Communications segment. The adjustments of $20 million represent exit cost accruals

across all segments which were no longer needed. The 2003 amount used of $57 million reÖects cash payments of

$52 million and non-cash utilization of $5 million. The remaining accrual of $143 million, is included in Accrued

Liabilities in the Company's consolidated balance sheets. From this remaining accrual, in 2004, the Company paid

out $38 million and reversed $32 million. The remaining accrual represents future cash payments, primarily for lease

termination obligations.

Employee Separation Costs

At January 1, 2003, the Company had an accrual of $336 million for employee separation costs, representing

the severance costs for approximately 5,700 employees, of which 2,000 were direct employees and 3,700 were

indirect employees. The additional charges of $163 million represented the severance costs for approximately

3,200 employees, of which 1,200 were direct employees and 2,000 were indirect employees. The accrual was for

various levels of employees. The adjustments of $125 million represent the severance costs for approximately

1,600 employees previously identiÑed for separation who resigned from the Company and did not receive severance

or were redeployed due to circumstances not foreseen when the original plans were approved.

During 2003, approximately 5,200 employees, of which 2,000 were direct employees and 3,200 were indirect

employees, were separated from the Company. The 2003 amount used of $258 million reÖects $254 million of cash

payments to these separated employees and $4 million of non-cash utilization. The remaining accrual of

$116 million is included in Accrued Liabilities in the Company's consolidated balance sheets. From this remaining

accrual, in 2004, the Company paid out $69 million, reversed $33 million and expects $14 million of future cash

payments to be paid out to separated employees during the Ñrst quarter of 2005.

For the Year Ended December 31, 2002

For the year ended December 31, 2002, the Company recorded net reorganization of businesses charges of

$673 million, including $68 million in Costs of Sales and $605 million under Reorganization of Businesses in the

Company's consolidated statements of operations.

Included in the aggregate $673 million charge is $918 million of additional charges and $245 million of

reversals of accruals no longer needed. The additional charges of $918 million were comprised of the following:

(i) $275 million in the Personal Communications segment, primarily related to the shut-down of an engineering

and distribution center in Illinois, (ii) $224 million in the Global Telecom Solutions segment, primarily related to

segment-wide employee separation costs and for exit costs relating to a lease cancellation fee, and (iii) $419 million

for employee separation, Ñxed asset impairments and lease cancellation fees across all other segments. The

$918 million charge was oÅset by $245 million of reversals of previous accruals, consisting of: (i) $108 million

relating to unused accruals of previously expected employee separation costs across all segments, (ii) $77 million,

primarily for exit cost accruals no longer required across all segments, and (iii) $60 million primarily for assets that

the Company intended to use that were previously classiÑed as held-for-sale.