Motorola 2004 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118 MOTOROLA INC. AND SUBSIDIARIESNOTES TO

CONSOLIDATED FINANCIAL STATEMENTS (Dollars in millions, except as noted)

For the Year Ended December 31, 2003

For the year ended December 31, 2003, the Company recorded net reorganization of businesses charges of

$39 million, including $16 million in Costs of Sales and $23 million under Reorganization of Businesses in the

Company's consolidated statements of operations.

Included in the aggregate $39 million net charge are $212 million of charges and $173 million of reversals of

accruals no longer needed. The charges primarily consisted of: (i) $85 million in the Personal Communications

segment, primarily related to the exit of certain manufacturing activities in Flensburg, Germany and the closure of

an engineering center in Boynton Beach, Florida, (ii) $50 million in the Commercial, Government and Industrial

Solutions segment for segment-wide employee separation costs, and (iii) $39 million in General Corporate,

primarily for the impairment of assets classiÑed as held-for-sale and employee separation costs. The $212 million of

charges were partially oÅset by reversals of previous accruals of $173 million, consisting of: (i) $125 million

relating to unused accruals of previously-expected employee separation costs across all segments, (ii) $28 million,

primarily for assets that the Company intended to use that were previously classiÑed as held-for-sale, and

(iii) $20 million for exit cost accruals no longer required across all segments.

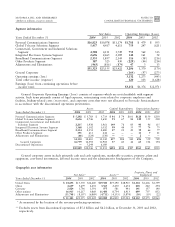

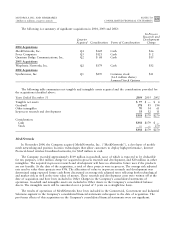

Reorganization of Businesses ChargesÌby Segment

The following table displays the net charges incurred by segment for the year ended December 31, 2003:

Exit Employee Asset

Segment Costs Separations Writedowns Total

Personal Communications $ 6 $ 43 $ 2 $ 51

Global Telecom Solutions (3) (30) (6) (39)

Commercial, Government and Industrial Solutions (3) 35 Ì 32

Integrated Electronic Systems (1) Ì Ì (1)

Broadband Communications 1 (4) (4) (7)

Other Products (3) 7 Ì 4

(3) 51 (8) 40

General Corporate (6) (13) 18 (1)

$(9) $ 38 $10 $ 39

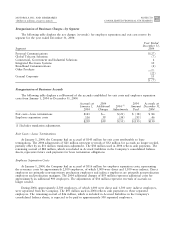

Reorganization of Businesses Accruals

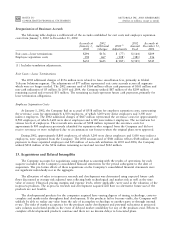

The following table displays a rollforward of the accruals established for exit costs and employee separation

costs from January 1, 2003 to December 31, 2003:

Accruals at 2003 2003 Accruals at

January 1, Additional 2003(1) Amount December 31,

2003 Charges Adjustments Used 2003

Exit costsÌlease terminations $209 $ 11 $ (20) $ (57) $143

Employee separation costs 336 163 (125) (258) 116

$545 $174 $(145) $(315) $259

(1) Includes translation adjustments

Exit CostsÌLease Terminations

The 2003 additional charges of $11 million were primarily related to the exit of certain manufacturing activities

in Germany by the Personal Communications segment. The adjustments of $20 million represent exit cost accruals

across all segments which were no longer needed. The 2003 amount used of $57 million reÖects cash payments of

$52 million and non-cash utilization of $5 million. The remaining accrual of $143 million, is included in Accrued

Liabilities in the Company's consolidated balance sheets. From this remaining accrual, in 2004, the Company paid

out $38 million and reversed $32 million. The remaining accrual represents future cash payments, primarily for lease

termination obligations.