Motorola 2004 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

outstanding short-term receivables that have been sold was $25 million at both December 31, 2004 and 2003 with

reserves of $4 million and $13 million recorded for potential losses on this exposure at December 31, 2004 and

2003, respectively.

Other Contingencies

Potential Contractual Damage Claims in Excess of Underlying Contract Value: In certain circumstances, our

businesses may enter into contracts with customers pursuant to which the damages that could be claimed by the

other party for failed performance might exceed the revenue the Company receives from the contract. Contracts

with these sorts of uncapped damage provisions are fairly rare, but individual contracts could still represent

meaningful risk. Although it has not previously happened to the Company, there is a possibility that a damage claim

by a counterparty to one of these contracts could result in expenses to the Company that are far in excess of the

revenue received from the counterparty in connection with the contract.

Legal Matters: The Company has several lawsuits Ñled against it relating to the Iridium program, as further

described under ""Item 3: Legal Proceedings'' of this document. The Company has not reserved for any potential

liability that may arise as a result of litigation related to the Iridium program. While the still pending cases are in

very preliminary stages and the outcomes are not predictable, an unfavorable outcome of one or more of these

cases could have a material adverse eÅect on the Company's consolidated Ñnancial position, liquidity or results of

operations.

The Company is a defendant in various other lawsuits, including product-related suits, and is subject to various

claims which arise in the normal course of business. In the opinion of management, and other than discussed above

with respect to the still pending Iridium cases, the ultimate disposition of these matters will not have a material

adverse eÅect on the Company's consolidated Ñnancial position, liquidity or results of operations.

Segment Information

The following commentary should be read in conjunction with the Ñnancial results of each reporting segment

as detailed in Note 10, ""Information by Segment and Geographic Region,'' to the Company's consolidated Ñnancial

statements.

Net sales and operating results for the Company's major operations for 2004, 2003 and 2002 are presented

below.

In April 2004, the Company separated its semiconductor operations into a separate subsidiary, Freescale

Semiconductor, Inc. (""Freescale Semiconductor''). In July 2004, an initial public oÅering of a minority interest of

approximately 32.5% of Freescale Semiconductor was completed. On December 2, 2004, Motorola completed the

spin-oÅ of Freescale Semiconductor from the Company by distributing its remaining 67.5% equity interest in

Freescale Semiconductor to Motorola shareholders. As of that date, Freescale Semiconductor is an entirely

independent company. The Ñnancial results of Freescale Semiconductor have been presented in Motorola's

consolidated Ñnancial statements as a discontinued operation.

Personal Communications Segment

The Personal Communications segment (""PCS'') designs, manufactures, sells and services wireless handsets

with integrated software and accessory products. In 2004, PCS's net sales represented 54% of the Company's

consolidated net sales, compared to 47% in 2003 and 48% in 2002.

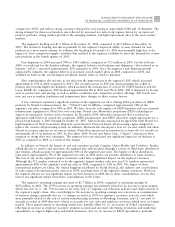

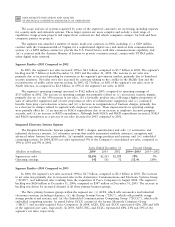

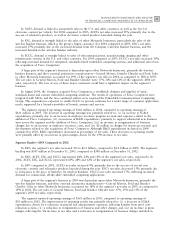

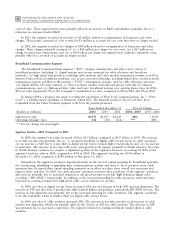

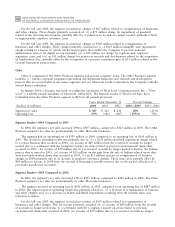

Years Ended December 31 Percent Change

(Dollars in millions)

2004

2003 2002

2004Ì2003

2003Ì2002

Segment net sales $16,823 $10,978 $11,174 53% (2)%

Operating earnings 1,708 479 503 257% (5)%

Segment ResultsÌ2004 Compared to 2003

In 2004, the segment's net sales increased 53% to $16.8 billion, compared to $11.0 billion in 2003. The 53%

increase in net sales in 2004 was driven by increases in both unit shipments and average selling price (""ASP'')