Motorola 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

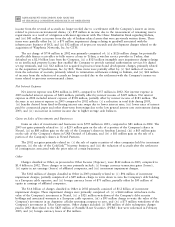

Item 6: Selected Financial Data

Motorola, Inc. and Subsidiaries

Five Year Financial Summary

Years Ended December 31

(Dollars in millions, except as noted)

2004

2003 2002 2001 2000

Operating Results

Net sales $ 31,323 $ 23,155 $ 23,422 $ 26,468 $ 32,107

Costs of sales 20,826 15,588 15,741 19,673 22,401

Gross margin 10,497 7,567 7,681 6,795 9,706

Selling, general and administrative expenses 4,209 3,529 3,991 4,369 5,031

Research and development expenditures 3,060 2,799 2,774 3,312 3,426

Reorganization of businesses (15) 23 605 1,245 326

Other charges (income) 111 (57) 754 2,091 293

Operating earnings (loss) 3,132 1,273 (443) (4,222) 630

Other income (expense):

Interest expense, net (199) (294) (355) (390) (164)

Gains on sales of investments and businesses, net 460 539 81 1,931 1,526

Other (141) (142) (1,354) (1,201) (72)

Total other income (expense) 120 103 (1,628) 340 1,290

Earnings (loss) from continuing operations before

income taxes 3,252 1,376 (2,071) (3,882) 1,920

Income tax expense (beneÑt) 1,061 448 (721) (876) 711

Earnings (loss) from continuing operations 2,191 928 (1,350) (3,006) 1,209

Earnings (loss) from discontinued operations,

net of tax (659) (35) (1,135) (931) 109

Net earnings (loss) $ 1,532 $ 893 $ (2,485) (3,937) 1,318

Per Share Data (in dollars)

Diluted earnings (loss) from continuing operations per

common share $ 0.90 $ 0.39 $ (0.59) $ (1.36) $ 0.54

Diluted earnings (loss) per common share 0.64 0.38 (1.09) (1.78) $ 0.58

Diluted weighted average common shares outstanding

(in millions) 2,472.0 2,351.2 2,282.3 2,213.3 2,256.6

Dividends paid per share $ 0.16 $ 0.16 $ 0.16 $ 0.16 $ 0.16

Balance Sheet

Total assets $ 30,889 $ 32,046 $ 31,233 $ 33,398 $ 42,343

Long-term debt and redeemable preferred securities 4,578 7,159 7,660 8,769 4,777

Total debt and redeemable preferred securities 5,295 8,028 9,159 9,462 11,167

Total stockholders' equity 13,331 12,689 11,239 13,691 18,612

Other Data

Capital expenditures $ 494 $ 344 $ 387 $ 708 $ 1,724

% of sales 1.6% 1.5% 1.7% 2.7% 5.4%

Research and development expenditures $ 3,060 $ 2,799 $ 2,774 $ 3,312 $ 3,426

% of sales 9.8% 12.1% 11.8% 12.5% 10.7%

Year-end employment (in thousands)* 68 88 97 111 147

* Employment decrease in 2004 primarily reÖects the impact of the spin-oÅ of Freescale Semiconductor.