Motorola 2004 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123

MOTOROLA INC. AND SUBSIDIARIES NOTES TO

CONSOLIDATED FINANCIAL STATEMENTS(Dollars in millions, except as noted)

The results of operations of Winphoria have been included in the Global Telecom Solutions segment in the

Company's consolidated Ñnancial statements subsequent to the date of acquisition. The pro forma eÅects of this

acquisition on the Company's consolidated Ñnancial statements were not signiÑcant.

Synchronous

In January 2002, the Broadband Communications segment acquired Synchronous, Inc. (""Synchronous''), a

leading provider of Ñber optic systems for video, data and voice transmission. Approximately 16.2 million shares of

the Company's common stock were exchanged for Synchronous' outstanding shares. The total purchase price was

$270 million, which includes transaction costs.

The acquisition was accounted for using the purchase method of accounting. The Company recorded

$194 million in goodwill, an $11 million charge for acquired in-process research and development and $60 million

in other intangibles. At the date of acquisition, a total of four projects were in process. The average risk adjusted

rate used to value these projects was 40%. The acquired in-process research and development is included in Other

Charges in the Company's consolidated statements of operations for the year ended December 31, 2002. Goodwill

and other intangible assets are included in Other Assets in the Company's consolidated balance sheets. Other

intangibles are being amortized over periods ranging from 7 to 10 years on a straight-line basis.

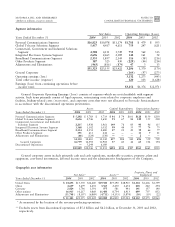

Intangible Assets

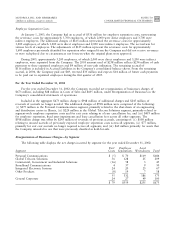

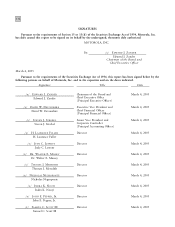

Amortized intangible assets, excluding goodwill were comprised of the following:

2004

2003

Gross

Gross

Carrying Accumulated

Carrying Accumulated

December 31

Amount Amortization

Amount Amortization

Intangible assets:

Licensed technology $112 $102 $102 $101

Completed technology 395 242 359 203

Other intangibles 72 23 27 11

$579 $367 $488 $315

Amortization expense on intangible assets was $52 million, $101 million and $66 million for the years ended

December 31, 2004, 2003 and 2002, respectively. Future amortization expense is estimated to be as follows:

2005Ì$57 million; 2006Ì$52 million; 2007Ì$45 million; 2008Ì$31 million; and 2009Ì$22 million.

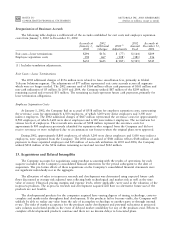

The following tables display a rollforward of the carrying amount of goodwill from January 1, 2003 to

December 31, 2004, by business segment:

January 1, December 31,

Segment 2004 Acquired Adjustments 2004

Personal Communications $ 17 $ Ì $ Ì $ 17

Global Telecom Solutions 97 Ì Ì 97

Commercial, Government and Industrial Solutions 123 134 Ì 257

Integrated Electronic Systems 71 59 Ì 130

Broadband Communications 782 Ì Ì 782

Other Products 125 Ì (125) Ì

$1,215 $193 $(125) $1,283