Motorola 2004 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

As further described under ""Customer Financing Arrangements'' below, for many years the Company has

utilized a receivables program to sell a broadly-diversiÑed group of short-term receivables, through Motorola

Receivables Corporation (""MRC''), to third parties. The obligations of the third parties to continue to purchase

receivables under the MRC short-term receivables program could be terminated if the Company's long-term debt

was rated lower than ""BB°'' by S&P or ""Ba1'' by Moody's (which would be a decline of two levels from the

current Moody's rating). If the MRC short-term receivables program were terminated, the Company would no

longer be able to sell its short-term receivables in this manner, but it would not have to repurchase previously-sold

receivables.

Credit Facilities

At December 31, 2004, the Company's total domestic and non-U.S. credit facilities totaled $2.9 billion, of

which $76 million was considered utilized. These facilities are principally comprised of: (i) a $1.0 billion three-year

revolving domestic credit facility maturing in May 2007 (the ""3-Year Credit Facility'') which is not utilized, and

(ii) $1.9 billion of non-U.S. credit facilities (of which $76 million was considered utilized at December 31, 2004).

The 3-Year Credit Facility replaced the Company's former $700 million 364-day revolving domestic credit facility

and $900 million three-year revolving domestic credit facility. Unused availability under the existing credit facilities,

together with available cash and cash equivalents and other sources of liquidity, are generally available to support

outstanding commercial paper, which was $300 million at December 31, 2004. In order to borrow funds under the

3-Year Credit Facility, the Company must be in compliance with various conditions, covenants and representations

contained in the agreements. Important terms of the 3-Year Credit Facility include covenants relating to net interest

coverage and total debt to book capitalization ratios. The Company was in compliance with the terms of the

3-Year Credit Facility at December 31, 2004. The Company has never borrowed under its domestic revolving credit

facilities.

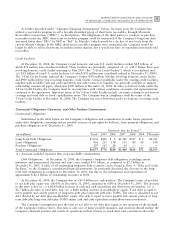

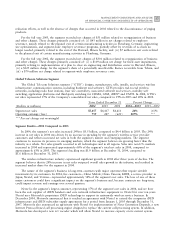

Contractual Obligations, Guarantees, and Other Purchase Commitments

Contractual Obligations

Summarized in the table below are the Company's obligations and commitments to make future payments

under debt obligations (assuming earliest possible exercise of put rights by holders), lease payment obligations, and

purchase obligations as of December 31, 2004.

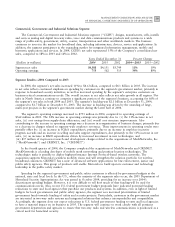

Payments Due by Period(1)

(in millions) Total 2005 2006 2007 2008 2009 Thereafter

Long-Term Debt Obligations $5,032 $400 $ 2 $1,340 $527 $ 2 $2,761

Lease Obligations 836 211 158 115 89 69 194

Purchase Obligations 207 165 28 14 Ì Ì Ì

Total Contractual Obligations $6,075 $776 $188 $1,469 $616 $71 $2,955

(1) Amounts included represent Ñrm, non-cancellable commitments.

Debt Obligations: At December 31, 2004, the Company's long-term debt obligations, including current

maturities and unamortized discount and issue costs, totaled $5.0 billion, as compared to $7.2 billion at

December 31, 2003. A table of all outstanding long-term debt securities can be found in Note 4, ""Debt and Credit

Facilities,'' to the Company's consolidated Ñnancial statements. As previously discussed, the decrease in the long-

term debt obligations as compared to December 31, 2003, was due to the redemptions and repurchases of

approximately $2.2 billion of outstanding securities in 2004.

At December 31, 2004, the Company was in a $5.4 billion net cash position. The Company's ratio of net debt

to net debt plus equity was (68.4)% at December 31, 2004, compared to 0.8% at December 31, 2003. The decrease

in this ratio is due to: (i) a $2.8 billion increase in cash and cash equivalents and short-term investments, (ii) a

$2.7 billion decrease in total debt, and (iii) a $642 million increase in stockholders' equity. Total debt is equal to

notes payable and current portion of long-term debt plus long-term debt plus TOPrS. The ratio is calculated as net

debt divided by net debt plus stockholders' equity. Net debt is equal to notes payable and current portion of long-

term debt plus long-term debt plus TOPrS minus cash and cash equivalents minus short-term investments.

The Company's management uses the ratio of net debt to net debt plus equity as one measure of the strength

of the Company's balance sheet. This ratio is only one of many possible measures, and investors should analyze the

Company's Ñnancial position and results of operations in their entirety to reach their own conclusions about the