Motorola 2004 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2004 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

MOTOROLA INC. AND SUBSIDIARIES NOTES TO

CONSOLIDATED FINANCIAL STATEMENTS(Dollars in millions, except as noted)

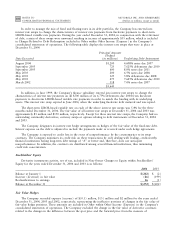

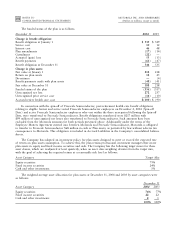

SigniÑcant components of deferred tax assets (liabilities) are as follows:

December 31

2004

2003

Inventory $ 246 $ 228

Employee beneÑts 865 711

Capitalized items 1,238 1,372

Tax basis diÅerences on investments 306 570

Depreciation tax basis diÅerences on Ñxed assets 96 121

Undistributed non-U.S. earnings (550) (261)

Tax carryforwards 2,138 1,835

Available for sale securities (871) (901)

Business reorganization 24 90

Long-term Ñnancing reserves 868 897

Warranty and customer reserves 504 361

Valuation Allowances (831) (801)

Other (139) (85)

$3,894 $4,137

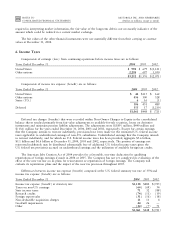

Gross deferred tax assets were $9.7 billion and $8.8 billion at December 31, 2004 and 2003, respectively.

Deferred tax assets, net of valuation allowances, were $8.9 billion and $8.0 billion at December 31, 2004 and 2003,

respectively. Gross deferred tax liabilities were $5.0 billion and $3.9 billion at December 31, 2004 and 2003,

respectively.

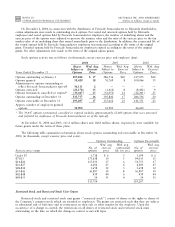

The Company had U.S. tax carryforwards of $1.5 billion and $1.2 billion at December 31, 2004 and 2003,

respectively. At December 31, 2004, these carryforwards were comprised of $683 million of net operating loss

carryforwards, $364 million of foreign tax credit carryovers, $215 million of general business credit carryovers,

$127 million of minimum tax credit carryforwards and $115 million of capital loss carryforwards. The Company's

non-U.S. subsidiaries, primarily in Germany and the UK, had tax loss carryforwards of $634 million and

$639 million at December 31, 2004 and 2003, respectively.

A majority of the U.S. net operating losses and general business credits can be carried forward for 20 years,

capital losses can be carried forward for Ñve years and minimum tax credits can be carried forward indeÑnitely. The

carryforward period for foreign tax credits was extended to 10 years, from 5 years, during 2004 due to the

enactment of the American Jobs Creation Act of 2004.

The Company has recorded valuation allowances for certain state deferred tax assets, state tax loss

carryforwards with carryforward periods of seven years or less, tax loss carryforwards of acquired entities that are

subject to limitations and tax loss carryforwards of certain non-U.S. subsidiaries. The Company believes that the

deferred tax assets for the remaining tax carryforwards are considered more likely than not to be realizable based

on estimates of future taxable income and the implementation of tax planning strategies.

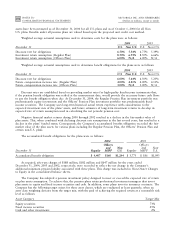

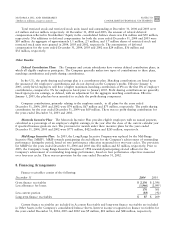

During 2004, the Company recorded the reversal of $316 million of previously-accrued income taxes as a result

of settlements reached with taxing authorities and a reassessment of tax exposures based on the status of current

audits. Of the $316 million reversal, $241 million was recorded as a reduction in tax expense and $75 million,

which related to previously-issued warrants, was reÖected as an increase in Additional Paid-In Capital in the

Company's consolidated balance sheets. During 2003 the Company recorded the reversal of $61 million of

previously-accrued income taxes related to the settlement of tax audits.

During 2004, the Internal Revenue Service (IRS) completed its Ñeld examination of the Company's 1996

through 2000 tax returns. In connection with this examination, the Company received notices of certain

adjustments proposed by the IRS, primarily related to transfer pricing. The Company disagrees with these proposed

transfer pricing-related adjustments and intends to vigorously dispute this matter through applicable IRS and judicial

procedures, as appropriate. However, if the IRS were to ultimately prevail on all matters relating to transfer pricing

for the period of the examination, it could result in additional taxable income for the years 1996 through 2000 of

approximately $1.4 billion, which could result in additional income tax liability for the Company of approximately

$500 million. The IRS may make similar claims for years subsequent to 2000 in future audits. Although the Ñnal

resolution of the proposed adjustments is uncertain, based on current information, in the opinion of the Company's

management, the ultimate disposition of these matters will not have a material adverse eÅect on the Company's

consolidated Ñnancial position, liquidity or results of operations. However, an unfavorable resolution could have a