MoneyGram 2004 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

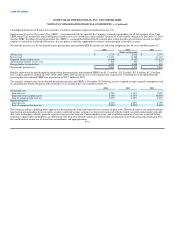

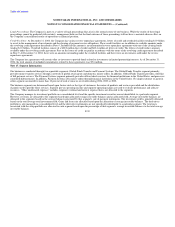

Legal Proceedings: The Company is party to a variety of legal proceedings that arise in the normal course of our business. While the results of these legal

proceedings cannot be predicted with certainty, management believes that the final outcome of these proceedings will not have a material adverse effect on

the Company's consolidated results of operations or financial position.

Credit Facilities: At December 31, 2004, the Company has various reverse repurchase agreements, letters of credit and overdraft facilities totaling $1.9 billion

to assist in the management of investments and the clearing of payment service obligations. These credit facilities are in addition to available amounts under

the revolving credit agreement described in Note 9. Included in this amount is an uncommitted reverse repurchase agreement with one of the clearing banks

totaling $1.0 billion. Overdraft facilities consist of a $20.0 million line of credit and $60.4 million of letters of credit. The letters of credit reduce amounts

available under the revolving credit agreement. Fees on the letters of credit are paid in accordance with the terms of the revolving credit agreement described

in Note 9. At December 31, 2004, there were no amounts outstanding under the overdraft facilities and there were no investments sold under the reverse

repurchase agreements.

The Company has agreements with certain other co-investors to provide funds related to investments in limited partnership interests. As of December 31,

2004, the total amount of unfunded commitments related to these agreements was $9.6 million.

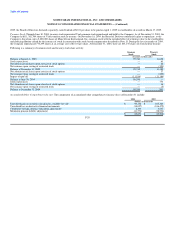

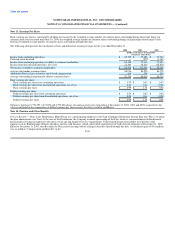

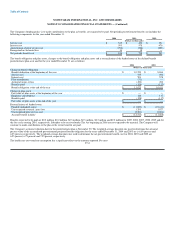

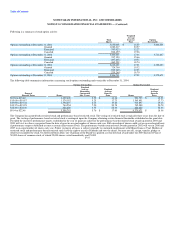

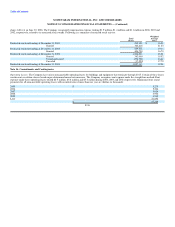

Note 17. Segment Information

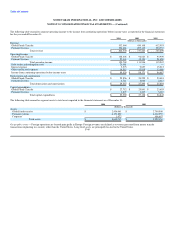

Our business is conducted through two reportable segments: Global Funds Transfer and Payment Systems. The Global Funds Transfer segment primarily

provides money transfer services through a network of global retail agents and domestic money orders. In addition, Global Funds Transfer provides a full line

of bill payment services. The Payment Systems segment primarily provides official check services for financial institutions in the United States, and processes

controlled disbursements. In addition, Payment Systems sells money orders through financial institutions in the United States. No single customer or agent in

either segment accounted for more than 10 percent of total revenue or receivables during 2004, 2003 or 2002.

The business segments are determined based upon factors such as the type of customers, the nature of products and services provided and the distribution

channels used to provide those services. Segment pre-tax operating income and segment operating margin are used to evaluate performance and allocate

resources. "Other unallocated expenses" includes corporate overhead and interest expense that is not allocated to the segments.

The Company manages its investment portfolio on a consolidated level and the specific investment securities are not identifiable to a particular segment.

However, revenues are allocated to the segments based upon allocated average investable balances and an allocated yield. Average investable balances are

allocated to the segments based on the average balances generated by that segment's sale of payment instruments. The investment yield is generally allocated

based on the total average total investment yield. Gains and losses are allocated based upon the allocation of average investable balances. The derivatives

portfolio is also managed on a consolidated level and the derivative instruments are not specifically identifiable to a particular segment. The total costs

associated with the swap portfolio are allocated to each segment based upon the percentage of that segment's average investable balances to the total average

investable balances. F-39