MoneyGram 2004 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

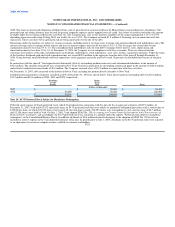

financial statements. These swaps are designated as cash flow hedges. The swap agreements are contracts to pay fixed and receive floating payments

periodically over the lives of the agreements without the exchange of the underlying notional amounts. The notional amounts of such agreements are used to

measure amounts to be paid or received and do not represent the amount of the exposure to credit loss. The amounts to be paid or received under the swap

agreements are accrued in accordance with the terms of the agreements and market interest rates.

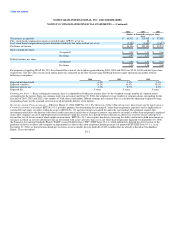

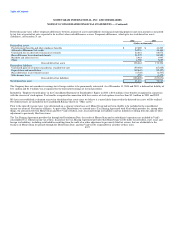

The notional amount of the swap agreements totaled $3.4 billion and $3.1 billion at December 31, 2004 and 2003, respectively, with an average fixed pay rate

of 4.8%, and 5.0% and an average variable receive rate 2.1% and 0.9% at December 31, 2004 and 2003, respectively. The variable rate portion of the swaps is

generally based on Treasury bill, federal funds, or 6 month LIBOR. As the swap payments are settled, the net difference between the fixed amount the

Company pays and the variable amount the Company receives is reflected in the Consolidated Statements of Income in "Investment commissions expense".

The Company estimates that approximately $29.5 million (net of tax) of the unrealized loss reflected in the "Accumulated other comprehensive income (loss)"

component in the Consolidated Balance Sheet as of December 31, 2004, will be reflected in the Consolidated Statement of Income in "Investment

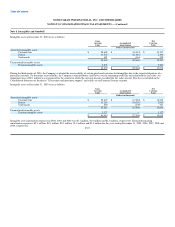

commissions expense" within the next 12 months as the swap payments are settled. The agreements expire as follows:

Notional Amount

(Dollars in thousands)

2005 $ 975,000

2006 630,000

2007 1,200,000

2008 100,000

Thereafter 502,000

$ 3,407,000

The amount recognized in earnings due to ineffectiveness of the cash flow hedges is not material.

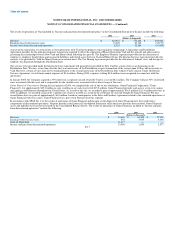

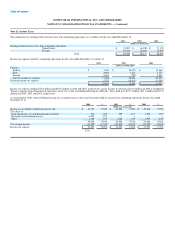

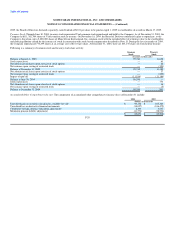

Fair value hedges use derivatives to mitigate the risk of changes in the fair values of assets, liabilities and certain types of firm commitments. The Company

uses fair value hedges to manage the impact of changes in fluctuating interest rates on certain available-for-sale securities. Interest rate swaps are used to

modify exposure to interest rate risk by converting fixed rate assets to a floating rate. All amounts have been included in earnings along with the hedged

transaction in the Consolidated Statement of Income in "Investment revenue." Realized gains of $0.1 million and $2.1 million were recognized on fair value

hedges discontinued during 2004 and 2003. No fair value hedges were discontinued in 2002.

The Company uses derivatives to hedge exposures for economic reasons, including circumstances in which the hedging relationship does not qualify for

hedge accounting. The Company is exposed to foreign currency exchange risk and utilize forward contracts to hedge assets and liabilities denominated in

foreign currencies. While these contracts economically hedge foreign currency risk, they are not designated as hedges for accounting purposes under SFAS

No. 133, Accounting for Derivative Instruments and Hedging Activities. The effect of changes in foreign exchange rates on the foreign-denominated

receivables and payables, net of the effect of the related forward contracts, recorded in the Consolidated Statement of Income is not significant.

The Company is exposed to credit loss in the event of nonperformance by counterparties to its derivative contracts. Collateral generally is not required of the

counterparties or of the Company. In the unlikely event a counterparty fails to meet the contractual terms of the derivative contract, the Company's risk is

limited to the fair value of the instrument. The Company actively monitors its exposure to credit risk through the use of credit approvals and credit limits, and

by selecting major international banks and financial institutions as counterparties. The Company has not had any historical instances of non-performance by

any counterparties, nor does it anticipate any future instances of non-performance.

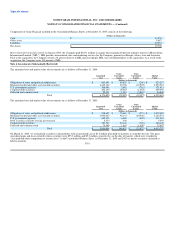

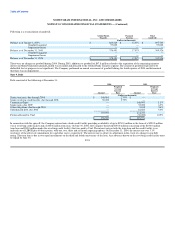

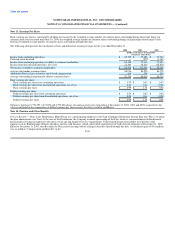

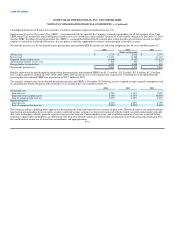

Note 6. Sale of Receivables

The Company has an agreement to sell undivided percentage ownership interests in certain receivables primarily from our money order agents. These

receivables are sold to two commercial paper conduit trusts F-21