MoneyGram 2004 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

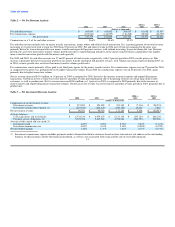

charge of $2.1 million related to intangible assets. Operating margin for 2003 declined from the 2002 operating margin of 7.3 percent (15.5 percent on a

taxable equivalent basis), primarily due to the interest rate environment.

Outlook

We believe that the following key items will have an impact on our future operations. We expect:

• To deliver earnings per share from continuing operations in 2005 in the range of $0.99 to $1.03, with income from continuing operations before taxes

growing 28 to 35 percent.

• Net revenues to grow six to 12 percent to $450.0 to $475.0 million.

• Our net investment margin in 2005 to be 130 to 140 basis points.

• Investable balances to average $6.5 billion in 2005.

• To continue paying a $0.01 per share quarterly cash dividend, subject to Board approval.

• To increase our marketing expenditures over 40 percent to solidify brand recognition.

• To no longer incur certain overhead costs allocated to us by Viad prior to the spin-off. These costs were $10.2 million during the first half of 2004.

• Our public company expenses to increase. In addition to other public company expenses, 2005 will be our first year of attesting to the operational

effectiveness of our internal controls under Section 404 of the Sarbanes-Oxley Act, with the related costs expected to amount to approximately $0.01 per

share.

• Our effective tax rate to be approximately 25 percent in 2005.

In 2005, we will be required to begin recognizing expense on our stock option awards under the new guidance of SFAS No. 123R, Share-Based Payment. We

did not factor the impact of this new requirement into the expectations set forth above; however, assuming we adopt SFAS No. 123R on January 1, 2005, we

expect the impact of expensing our stock options to be approximately $0.02 per share in 2005.

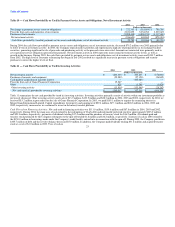

LIQUIDITY AND CAPITAL RESOURCES

One of our primary financial goals is to maintain adequate liquidity to manage the fluctuations in the balances of payment service assets and obligations

resulting from sales of official checks, money orders and other payment instruments, the timing of the collections of receivables, and the timing of the

presentment of such instruments for payment. In addition, we strive to maintain adequate liquidity for capital expenditures and other normal operating cash

needs.

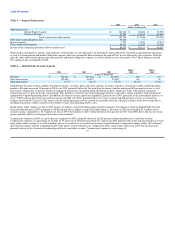

At December 31, 2004, we had cash and cash equivalents of $927.0 million, net receivables of $772.0 million and investments of $6,335.5 million, all

substantially restricted for payment service obligations. We rely on the funds from ongoing sales of payment instruments and portfolio cash flows to settle

payment service obligations as they are presented. Due to the continuous nature of the sales and settlement of our payment instruments, we are able to invest

in securities with a longer term than the average life of our payment instruments.

We are regulated by various state agencies, which generally require us to maintain liquid assets and investments with a rating of A or higher, in an amount

generally equal to the payment service obligation for regulated payment instruments (teller checks, agent checks, money orders and money transfers). We are

not regulated by state agencies for our payment service obligations resulting from outstanding cashier's checks; however, we restrict the funds related to these

payment instruments due to contractual arrangements and/or Company policy. Accordingly, assets restricted for regulatory or contractual reasons, and by

Company policy are not available to satisfy working capital or other financing requirements.

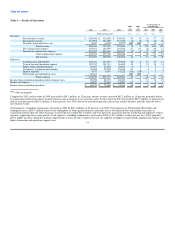

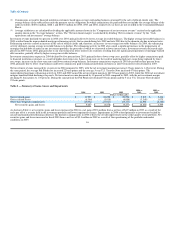

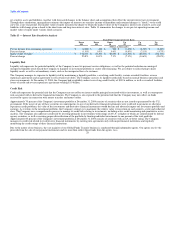

As of December 31, 2004 and 2003, we had unrestricted cash and cash equivalents, receivables, and investments to the extent those assets exceed all payment

service obligations as summarized in Table 8. These amounts are generally available; however, management considers a portion of these amounts as

providing additional assurance that regulatory requirements are maintained during the normal fluctuations in the value of investments.

21