MoneyGram 2004 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

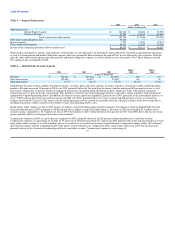

Interest Rate Risk

Interest rate risk represents the potential reduction in net investment revenue as a result of fluctuations in market interest rates. Fluctuations in interest rates

affect the revenue produced by our investment portfolio, the amount of commissions that we pay to customers in our Payment Systems segment, the net

proceeds from our sale of receivables and the amounts that we receive under our interest rate derivatives. As a result, our net investment revenue, which is the

difference or "spread" between the amount we earn on our investment portfolio and the commissions we pay and the discount on the sale of receivables, net of

the effect of interest rate derivatives or "swaps", is subject to interest rate risk as the components of net investment revenue are not perfectly matched through

time and across all possible interest rate scenarios. Interest rate risk is concentrated in the investment portfolio.

Certain investments in our portfolio, primarily fixed-rate mortgage-backed investments, are subject to prepayment with no penalty to the borrower. As interest

rates decrease, borrowers are more likely to prepay fixed-rate debt, resulting in cash flows that are received earlier than expected. Replacing the higher-rate

investments that prepay with lower rate investments could reduce our net investment revenue. Conversely, an increase in interest rates may result in slower

than expected prepayments and, therefore, cash flows that are received later than expected. In this case, there is risk that the cost of our commission payments

may reprice faster than our investments and at a higher cost, which could reduce our net investment revenue.

An additional component of interest rate risk is market risk that arises from fluctuations in interest rates that may result in changes in the values of

investments and swaps. Rate movements can affect the repricing of assets and liabilities differently, as well as their market value. Stockholders' equity can

also be adversely affected by changing interest rates, as after-tax changes in the fair value of securities classified as available-for-sale and after-tax changes in

the fair value of swaps are reflected as increases and decreases to a component of stockholders' equity. The fair value of our swaps generally increases when

the market value of fixed rate, long-term debt investments decline and vice versa. However, the changes in the fair value of swaps and investments may not

fully offset in stockholders' equity.

The Company's strategy in managing interest rate risk is to deliver consistent net interest margins and economic value over varying interest rate environments.

One element to our strategy is to purchase assets that have similar cash flow patterns to our payment service obligations through time and various interest rate

environments. To carry out this strategy, we purchase assets that match the average life and duration of our payment service obligations within a range that

achieves stable net interest margins. In addition, we purchase assets across a wide spectrum of average lives to achieve the desired asset duration. We also use

several different types of assets, including derivatives, to alter the average life of our assets and liabilities to match the duration of our payment service

obligations within a desired range. A second element to our strategy is to regularly assess the portfolio's exposure to changes in rates. We use a wide range of

risk measures and analyses to manage the exposure, including on-going business risk measures and analyses, run-off measures of the existing portfolio and

stress test scenarios. The two main evaluators used by the Company are net income at risk and duration gap. Net income at risk is measured using a static and

forecasted portfolio under various interest rate shock environments. Duration gap is the estimated gap between our assets and liabilities and summarizes the

extent that estimated cash flows are matched over time across various interest rate environments. The third element to our strategy is setting parameters for

rebalancing actions to help attain corporate margin objectives. Management develops rebalancing actions based upon a number of factors that include both net

investment revenue at risk and duration gap, as well as current market conditions. Internal indicators are used to determine when the risk profile of our assets

should be re-examined. As the risk measures begin to move beyond our internal indicators, we consider actions to bring them into the preferred ranges, with

an emphasis on time horizon and earnings objectives.

The Company uses derivatives as an important tool in managing interest rate risk. Derivatives are used by the Company as a hedging tool; we do not enter

into speculative trading positions. The Company typically uses interest rate swaps to hedge interest rate risk on its variable rate commission payments to

financial institution customers in its Payment Systems segment. Through these interest rate swaps, the Company can effectively convert our variable rate

commission payments to a fixed rate payment.

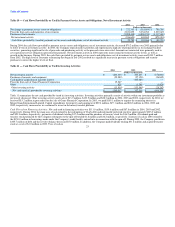

The Company uses net investment revenue simulation analysis and market value of equity modeling for measuring and analyzing consolidated interest rate

risk. The net investment revenue simulation analysis incorporates substantially all of the Company's inter-

27