MoneyGram 2004 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

• Investment revenue is derived from the investment of funds generated from the sale of official checks, money orders and other payment instruments and

consists of interest income, dividend income and amortization of premiums and discounts. These funds are available for investment until the items are

presented for payment. Interest and dividends are recognized as earned. Premiums and discounts on investments are amortized over the life of the

investment.

• Securities gains and losses are recognized upon the sale of securities using the specific identification method to determine the cost basis of securities sold.

Impairments are recognized in the period the security is deemed to be other-than-temporarily impaired.

Fee Commissions Expense — We pay fee commissions to third-party agents for money transfer services. In a money transfer transaction, both the agent

initiating the transaction and the agent disbursing the funds receive a commission. The commission amount is generally based on a percentage of the fee

charged to the customer. We generally do not pay commissions to agents on the sale of money orders. Fee commissions are recognized at the time of the

transaction. Fee commissions also include the amortization of the capitalized incentive payments to agents.

Investment Commissions Expense — Investment commissions expense includes amounts paid to financial institution customers based upon average

outstanding balances generated by the sale of official checks and costs associated with swaps and the sale of receivables program. Commissions paid to

financial institution customers generally are variable based on short-term interest rates; however, a portion of the commission expense has been fixed through

the use of interest rate swap agreements. Investment commissions are generally recognized each month based on the average outstanding balances and the

contractual variable rate for that month.

Stock Based Compensation — We account for stock option grants under the intrinsic value method in accordance with Accounting Principles Board Opinion

No. 25 ("APB 25"), Accounting for Stock Issued to Employees. This method defines compensation cost for stock options as the excess, if any, of the quoted

market price of the Company's stock at the date of the grant over the amount the employee must pay to acquire the stock. As our stock option plans require the

employee to pay an amount equal to the market price on the date of grant, no compensation expense is recognized under APB 25. Performance-based stock

and restricted stock awards are accounted for under the fair value method under SFAS No. 123, Accounting for Stock-Based Compensation and are valued at

the quoted market price of the Company's stock at the date of grant and are expensed using the straight-line method over the vesting or service period of the

award.

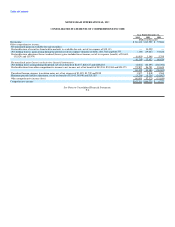

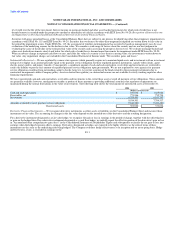

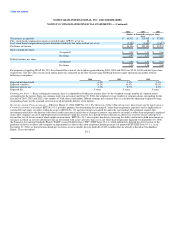

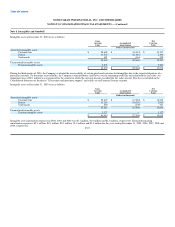

Assuming that we had recognized compensation cost for stock option grants in accordance with the fair value method of accounting defined in SFAS No. 123,

net income and diluted and basic income per share would be as presented in the following table. Compensation cost calculated under SFAS No. 123 is

recognized using a straight-line method over the vesting period and is net of estimated forfeitures and tax benefits.

F-14